Chile must be on the radar of emerging markets investors. Among the major markets in Latin America, Chile is one of the best market due to many factors. Equity investors looking for emerging market opportunities now can especially consider adding Chilean stock. Some of the reasons why Chilean stocks offer excellent potential for income and growth are:

- Chile is the world’s largest copper producer and exporter. After years of falling copper prices, copper is slowing moving up since the last quarter as shown in the chart below:

Click to enlarge

Source: Kitco

Source: Kitco

As copper prices go up the Chilean economy will benefit. Moreover it should be noted that copper accounts for about half of all exports from Chile.

- Chile is known for political stability in a region filled with many unstable economies.

- The country is a member of the OECD and has numerous free-trade agreements enabling Chile to take advantage of trade partnerships with many countries.

- Companies in Chile are required by law to distribute dividends to shareholders. By law, firms must pay at least 30% of their profits to shareholders. This type of law is unique in emerging countries.

- This year general elections are due in November.

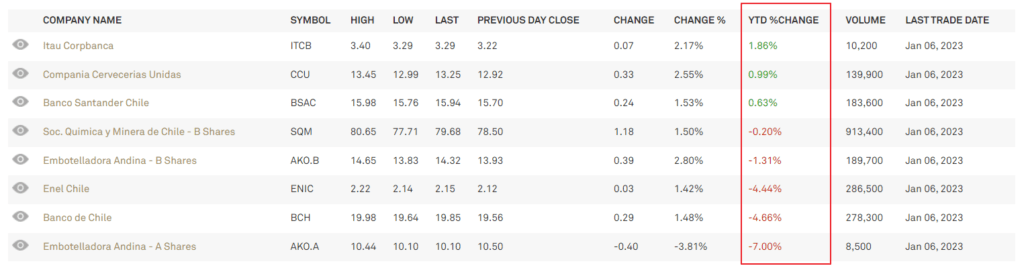

Some of the Chilean ADRs that investors can consider for further research include: Banco Santander- Chile (BSAC), Banco de Chile (BCH), Empresa Nacional de Electricidad SA (EOC), Itau CorpBanca (ITCB) and Vina Concha y Toro ( VCO)

The complete list of Chilean ADRs trading on the US markets can be found is here.

Disclosure: Long BCH and ITCB