The US Federal government collects more taxes each year from individuals than corporations in the form of income taxes. This may be surprising to some people since the US corporate income tax is one of the highest in the world and companies earn far higher earnings as profits than most individuals.

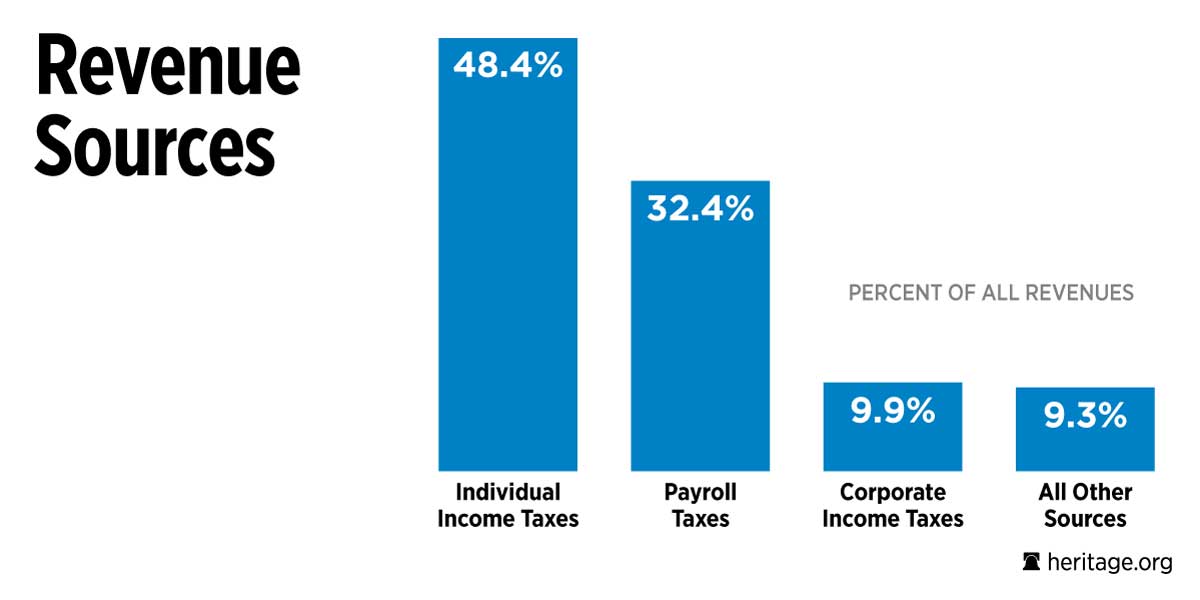

The following chart shows that nearly half of the Federal revenues come from individual income taxes:

Click to enlarge

Source: The Heritage Foundation

To put the above figures in perspective, in the fiscal year 2015 the total federal revenues were expected to be $3.18 trillion according to the National Priorities project. Out of this, individuals paid $1.48 Trillion in income taxes (47% of total). Corporations on the other hand paid just $341 billion (11% of total revenues).

Why do corporations pay less income taxes than individuals?

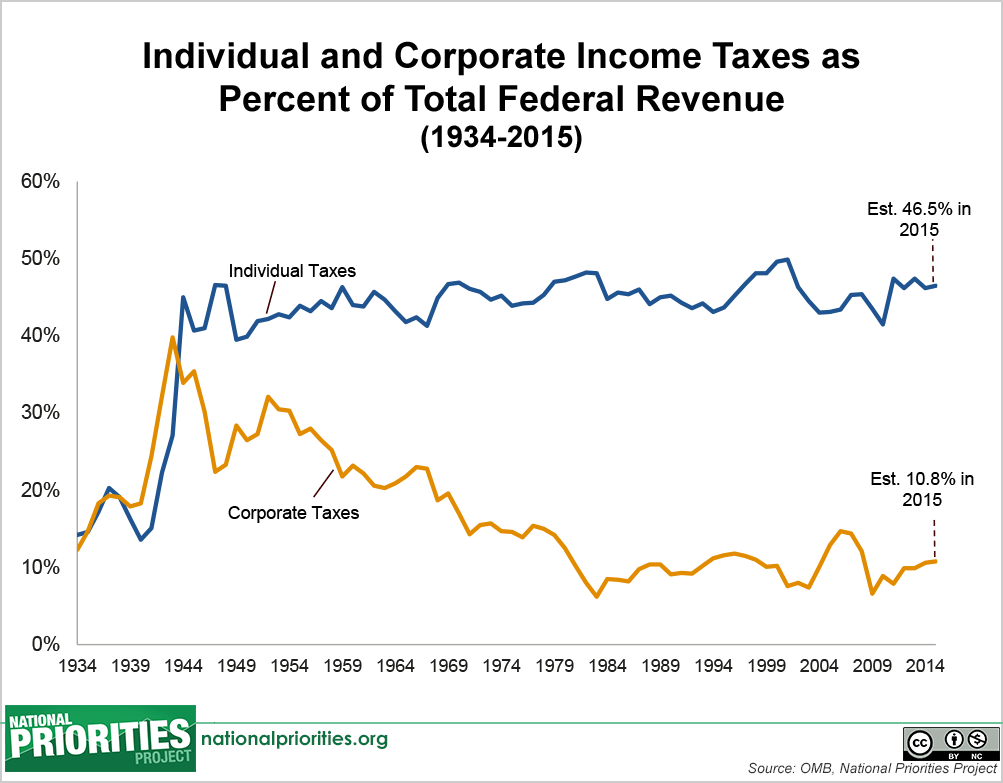

Though the corporate tax rate is 35%, most US companies pay much less. This is because of the millions of legal loopholes that are available for corporations in the tax code. Using an army of corporate lawyers, tax attorneys, accountants, lobbyists, consultants and other professionals whose only job is figure out how to legally reduce the taxes owed by a corporation to the minimum possible. Unlike corporations most individuals do not have the resources to hire all these folks to prepare their taxes. In addition, many of the thousands of loopholes that are afforded to corporations are not available to individuals. For example, Uncle Sam allows firms to use tax-avoidance tools like a Dutch Sandwich, Double Irish arrangement, etc. to shelter billions in taxes owed. As a results, corporate income taxes as a percentage of total federal revenues have declined year after year since the 1940s compared to individual income taxes.

Click to enlarge

Source: Federal Revenue: Where Does the Money Come From, National Priorities Project