Emerging equity markets have outperformed developed markets so far this year. Major emerging markets such as Brazil, Russia, India, etc. are up by double digit percentage points. China is a laggard with the Shanghai Composite down by 13% as of Sept 9th.

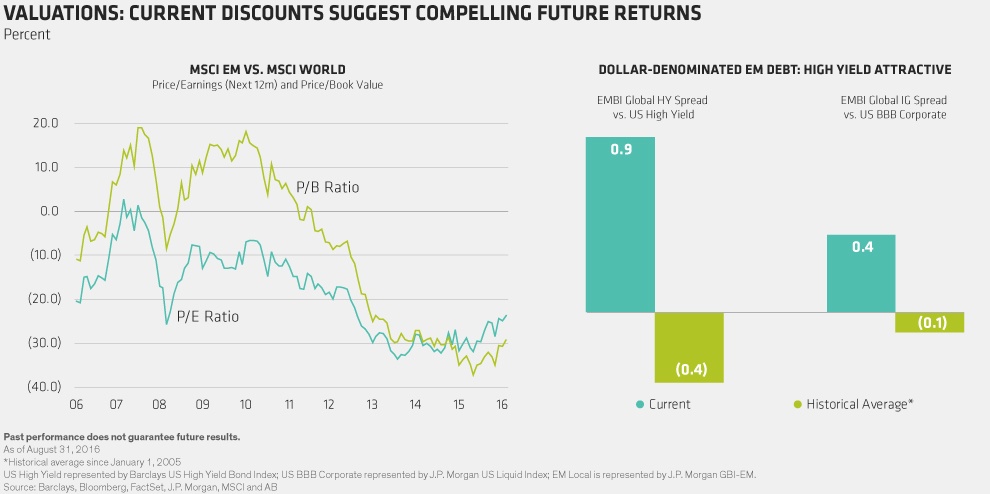

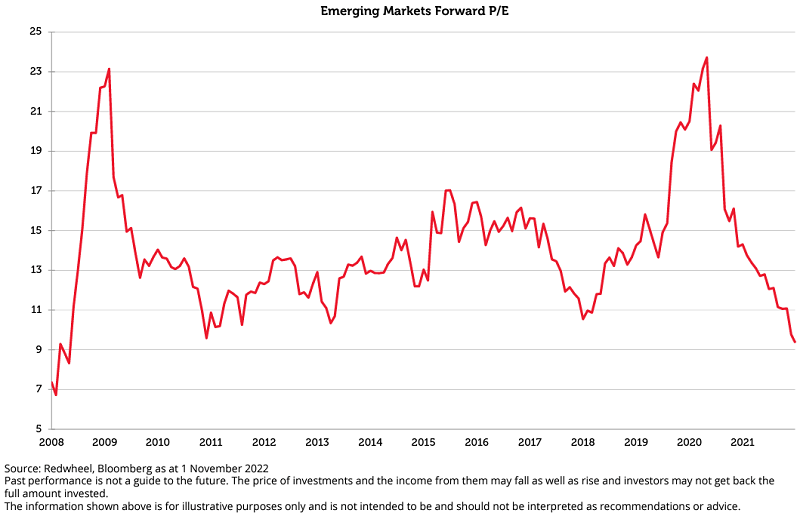

Despite the strong returns year-to-date emerging markets are still attractive on a valuation basis according to an article by Alliance Bernstein. The firm is bullish on EM with the authors noting factors such as improving growth prospects, politics, etc. in addition to the valuation . According to the article emerging markets are cheaper by 24% relative to developed markets.

Click to enlarge

Source: Reemerging Markets: Investing in a Developing Recovery, AB Blog

From an investment angle, it is important to note that emerging markets are trading at a discount compared to developed markets because they are still emerging. Developed markets traditionally command a premium. But in the short-term lower valuations can lead to further gains.

While investing in developing stocks it is wise to avoid investing via an index fund. I discussed the reason for this in an earlier article.

Some of the companies investors can consider for research include: Bancolombia S.A. (CIB), Standard Bank Group Limited (SGBLY), HDFC Bank Limited (HDB), Ultrapar Participacoes SA (UGP), etc.

Disclosure: Long CIB