Global investors used to consider emerging market as mainly commodity plays. Unlike developed markets other sectors such as banking, healthcare, IT, consumer staples, telecom, airlines, etc. did not get much attention from most investors. But today’s emerging countries are much more than just commodities, For instance, the Chilean economy is not confined to just copper, the Russian economy is more than just oil and gas, China is turning into a consumption-based economy, Mexico is a manufacturing leader than only an oil producer, etc. So investors looking to add exposure to emerging markets should cast their net wide and consider these markets for all types of sectors than only commodities.

From an interesting article on Emerging Markets by Merryn Somerset Webb at MoneyWeek:

In Latin America, Chile, Peru, Columbia and Brazil are making the right noises, while in Asia there are standouts such as Vietnam and Indonesia. For now, at least, says a note from Eurasia Group, there is a “positive inflection point in emerging market political stability”. But the convergence – and hence the argument for the disappearance of the emerging-market discount isn’t just about politics (obviously). It is also about structural shifts in the economic make-up of various countries.

Thirty years ago, emerging markets were all about commodities and cyclical investments. No more. According to Ashmore Investment Management, some 50% of the MSCI Emerging Market index is now made up of “structural growth drivers” such as telecoms, technology, consumer and healthcare companies. Overall, the tech share of emerging markets is higher than that of the S&P 500 (23% vs 21%). The commodity component has fallen to a mere 14% – less than half of what it was a decade ago.

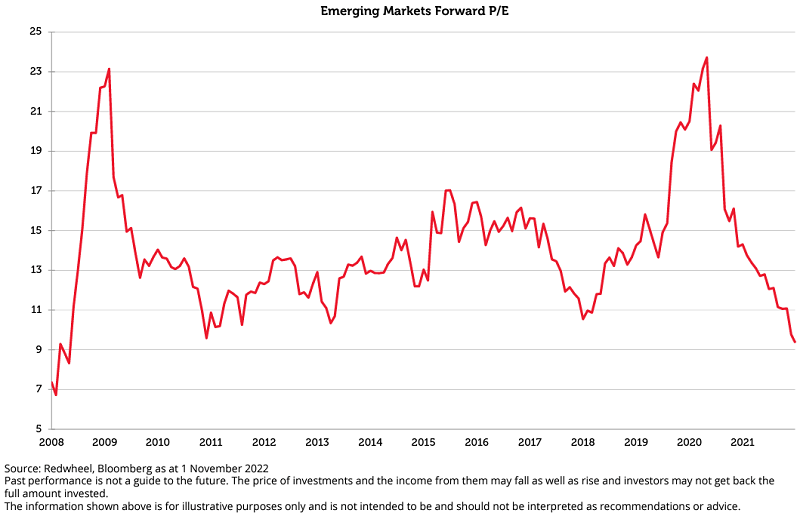

The equity universe in emerging markets is broader, deeper and hence much safer than investors think. That makes it too cheap. Structural growth companies “have superior earnings visibility for multiple years compared to cyclical ones”, says Ashmore, so investors should be paying up for them. One day they will. They might also soon be willing to pay up for income – the one thing you all tell me over and over again that you want more of.

Big companies in the West are close to the end of the dividend road: in the UK, ten FTSE 100 stocks account for 55% of the income – and their payout ratios are far too high for comfort. Across emerging markets, things are different. According to Invesco Perpetual, there is a much higher degree of “dividend diversification” in the market (95% of firms in the MSCI Asia Pacific ex Japan index pay out something) and with good earnings growth, robust cash flow, healthy balance sheets and payout ratios that are currently low, the most obvious direction for dividend payouts is up.

Source: Buy into emerging markets as they turn into developed markets, MoneyWeek

Some of the emerging market equities that investors can research further include: Empresa Nacional de Electricidad SA (EOC), Ultrapar Participacoes SA (UGP), HDFC Bank Ltd (HDB), PetroChina Co Ltd (PTR), Standard Bank Group (SGBLY), etc.

Disclosure: No Positiosn