Commodity investing have gone mainstream these days with investors bombarded with marketing materials promoting them as an alternative investment sector. However investing in commodities like copper, soya bean, orange juice, iron ore, etc. is not a wise strategy for most retail investors. Unlike stocks, commodities are highly volatile and it is very easy to lose money quickly. This is especially true with investing in futures where gains or losses can be exponential.

Most retail investors are better off avoiding commodities at all costs.

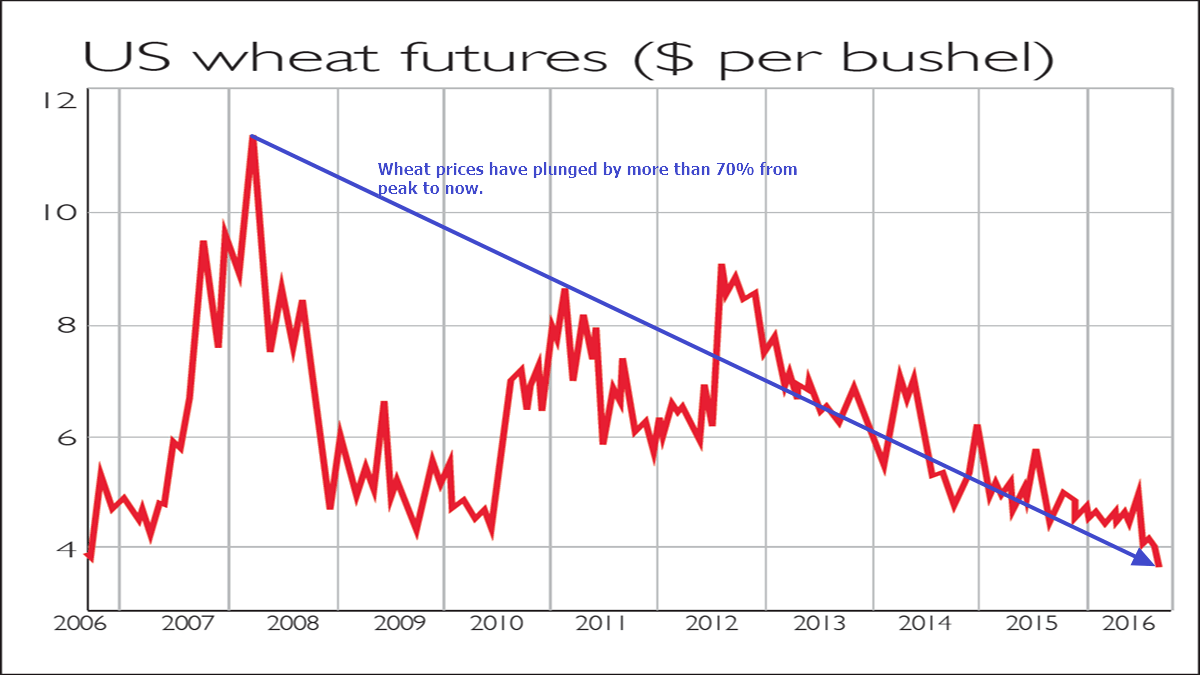

As an agricultural commodity wheat is traded widely and prices tend to fluctuate based on supply and demand for the most part. Before the Global Financial Csisi(GFC) wheat peaked at $14 per bushel. Since then prices have plunged by more than 70% and currently a the price of a bushel is below $4.

Click to enlarge

Source: Chart of the week: wheat mountain weighs on prices, MoneyWeek

The above example illustrates how much the price of a commodity can decline with almost no end in sight.