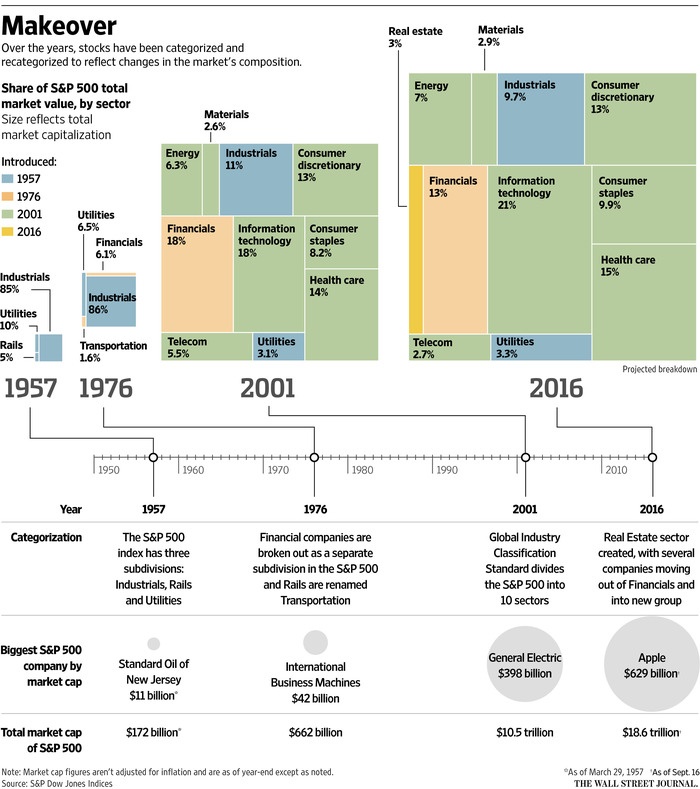

The S&P 500 currently is dividend into 10 sectors. This is about to change with Real Estate being added as the 11th sector. Real estate will be split from the financial sector and added as a sector of its own. No new companies will be added to the index.

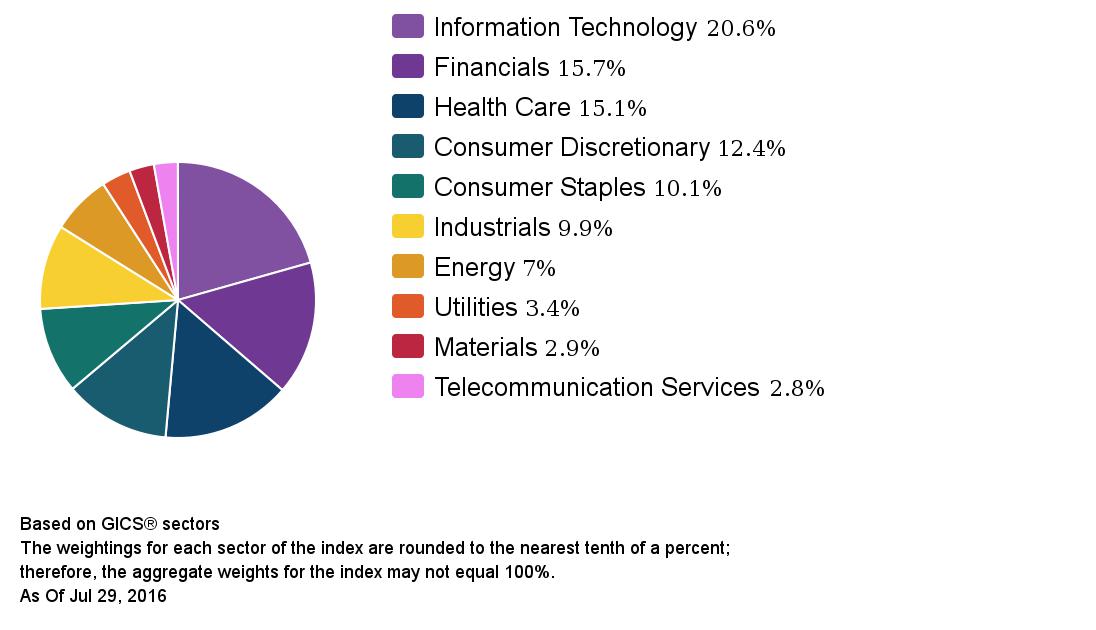

The existing sector composition of the S&P 500:

Click to enlarge

Source: S&P

IT dominates the S&P 500 with over 20% weightage. Financials and Healthcare constitute about 15% each. With the upcoming addition of real estate sector, financials will have a smaller weight in the index.

A short excerpt from a Schwab article on this topic:

The S&P 500® index has been divided into 10 sectors for quite some time—but that’s all about to change. At the beginning of September, real estate will become a shiny, brand-new 11th sector.

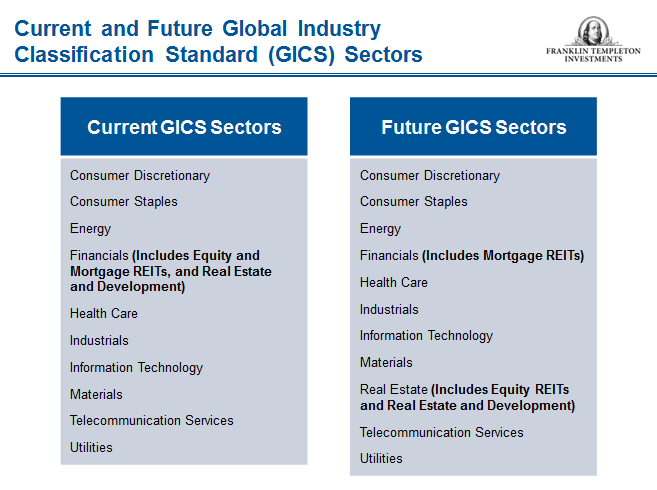

A quick reminder: Since its inception in 1999, the Global Industry Classification Standard, or GICS®—the most widely used sector categorization system, published by Standard & Poor’s and MSCI—has considered real estate a part of the financials sector. However, S&P and MSCI have determined that the real estate group should be spun out from the financial sector and get its own heading. They’re not adding companies that weren’t in the S&P 500, they’re shifting companies—28 to be exact, according to S&P—from financials to real estate.

The majority of the new sector will be made of equity real estate investment trusts (REITs), with some real estate development companies included. Equity REITs are companies that own physical property and typically receive some sort of rental income. Included in this group are companies that own such things as apartments, office property, malls, storage, etc. So-called mortgage REITs, which purchase mortgages as opposed to actual physical property, will not be included in the new sector and will remain in the financial sector.

So what should investors do?

Not much—at least for now. Depending on the investments that investors hold, they may have to adjust allocations once the dust settles a bit, but investors that hold mutual funds or certain exchange-traded funds (ETFs) may have the adjustments done for them. There isn’t a huge amount of urgency here, and the actual change doesn’t take place until the beginning of next month. Nevertheless, over the next couple of months it would be a good idea to determine what your funds did, and then determine what you may need to do to add or subtract to real estate exposure. At this point it looks like the new sector will make up about 3% of the S&P 500—not insignificant, but certainly not a major percentage.

Source: Schwab Sector Views: There’s a New Sector Coming, Aug 18, 2016, Charles Schwab

Related:

New Real Estate Component in S&P Index Could Leave Financial Stocks Adrift, WSJ, May 12, 2016

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No positions

Update (9/3/16):

Current and Future GIC Sectors Classification:

Click to enlarge

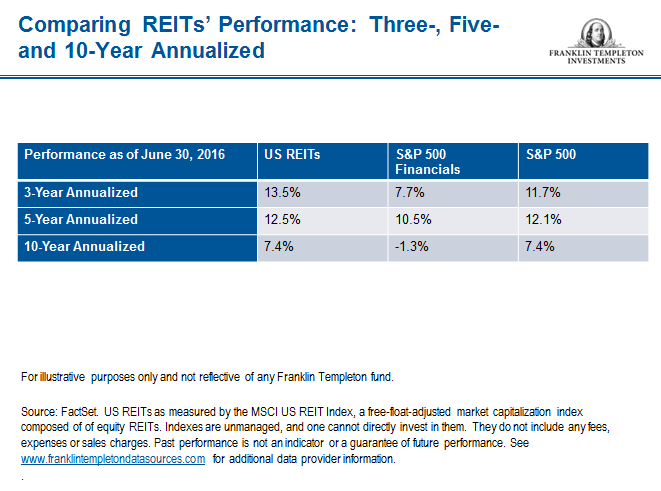

REITs Returns Over Years:

Source: Real Estate Breaks New Ground, Franklin Templeton Investments, Aug 29, 2016

Update (9/19/16):

Click to enlarge

Source: WSJ

i worked for ag edwards for 25 yrs.They were the only firm to cover reits before it was included in the s&P. The report was broken into Conservative Reits,moderate and risker ones . No one else did this ! It was the most successful report i have ever used! Why is this not done today?

Good nice. I am not sure. Nowadays firms are more interested in other areas like the software, semiconductors, social media, meme stocks, etc. Since REITs are more focused on income nobody seems to pay much attention to them and produce lists like the one you mention.

Thanks for the comment.