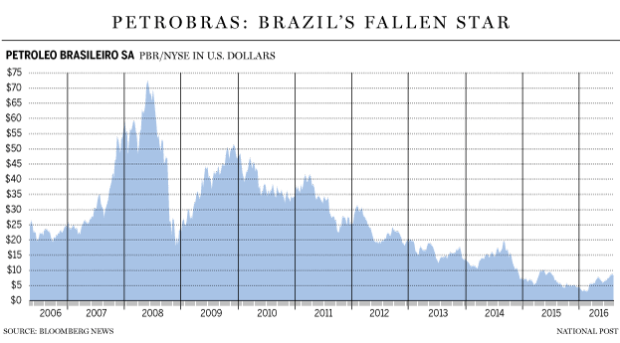

The stock price of Petrobras(PBR), Brazilian oil firm closed at $8.73 on Friday August 12th. The market cap stood at about $57 billion. This is a far cry from the peak market cap a few years ago when Petrobras was the rising superstar of the oil world and was considered the crown jewel of emerging Brazil. In 2008, the stock price reached over $70.

The decline in crude oil prices is one reason for the stock price plunge. However in Petrobras’ case the main reason for the collapse of the oil giant was corruption and fraud.

From Petrobras’ Olympic-sized oil woes: How the world was at Brazil’s feet, but kicked it away by Yadullah Hussain in the Financial Post on Aug 5, 2016:

“Petrobras is a complicated beast,” says Eurasia’s Neves. “We have seen moments in the last 15 to 20 years where Petrobras was driven by market dynamics rather than political dynamics — more recently it was the other way around. Now we are seeing the pendulum swing again.”

Government creep in Petrobras saw the company’s market cap fizzle to US$52.2 billion today from $241 billion in 2007 as it become a pure policy tool, forced to keep prices down to control inflation.

Petrobas’ debt has ballooned five-fold over the past nine years, while net income of US$13.1 billion in 2007 shriveled to a US$1.1 billion loss in the first quarter of 2016. Analysts have cast doubt over the company’s US$130 billion investment plans during the next five years.

“Our business and strategic plans are being revised and the new plans will be announced (at) the beginning of October,” Estephani Zavarise, a Petrobras media executive, said in an emailed statement.

The whole article is worth a read.

The Star also ran a article on Brazil’s rise and fall recently. From that piece:

Three billion people worldwide were expected to watch Friday night’s opening ceremony at the Rio 2016 Summer Olympic Games. In addition, more than 80,000 Brazilians, visitors and athletes were there in person in Rio de Janeiro’s iconic Maracana Stadium.

But expected to be missing in action was the man who almost single-handedly won the Olympics for Brazil — former president Luiz Inacio Lula da Silva, once regarded as the saviour of his country.

Now facing potential corruption charges, he announced last week that he would boycott the opening ceremony. And so did his successor and ally, suspended president Dilma Rousseff.

Their announcement came as no surprise to most Brazilians. The euphoria of winning the 2016 Games seven years ago has long vanished.

For the most part, polls suggest that Brazilians are unhappy hosts. Beyond the athletic exuberance of these Olympic Games lies a battered and demoralized country.

Source: Lula’s rise and fall mirrors Brazil’s road to Olympics: Burman, The Star, Aug 6, 2016

A few takeaways from the Petrobras collapse for global investors:

- Emerging markets are inherently riskier than developed markets and Brazil is no exception. So its important to allocate only a small percentage of one’s portfolio to emerging markets.

- Seemingly wonderful and great company can also turn into Enron-style frauds. Hence putting all eggs in one basket is a fool’s game.

- State-owned firms have different priorities than non-state owned firms. For example, Petrobras or other National Oil Companies such as Petronas of Malaysia may focus on employing thousands of employees and satisfying the demands of the state in every action the company takes. Private oil firms such as Exxon Mobil(XOM), Total(TOT), Chevron(CVX) , etc. are run for their shareholders and not the state. The US government cannot dictate where ExxonMobil should invest or how much dividends it should pay since the state does not own the company.

Disclosure: Long PBR