Canadian bank stocks are excellent investment option for long-term investing looking for steady dividend income and price appreciation. Among the top-five banks that dominate the market. most have good exposure to the US market. For instance, Canadian Imperial Bank of Commerce (CM) last week bought Chicago-based PrivateBancorp, Inc. (PVTB) to expand its footprint.

Instead of investing individually in each of the banks, some investors may be wondering if there is an ETF that tracks Canadian banks. Currently there is no ETF trades on the US exchanges that tracks Canadian banks. However there are ETFs trading on the Toronto Stock Exchange.

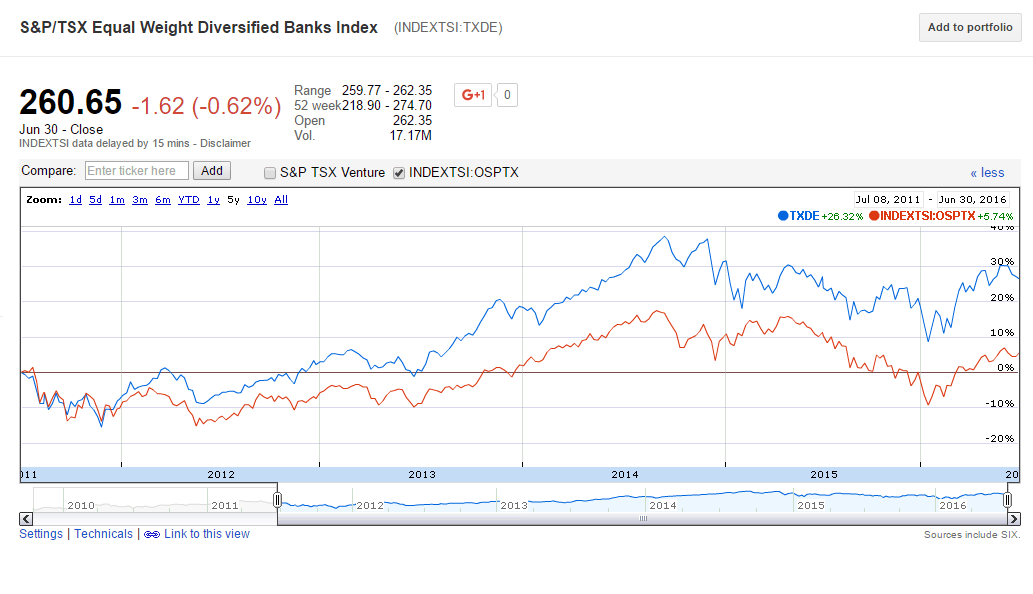

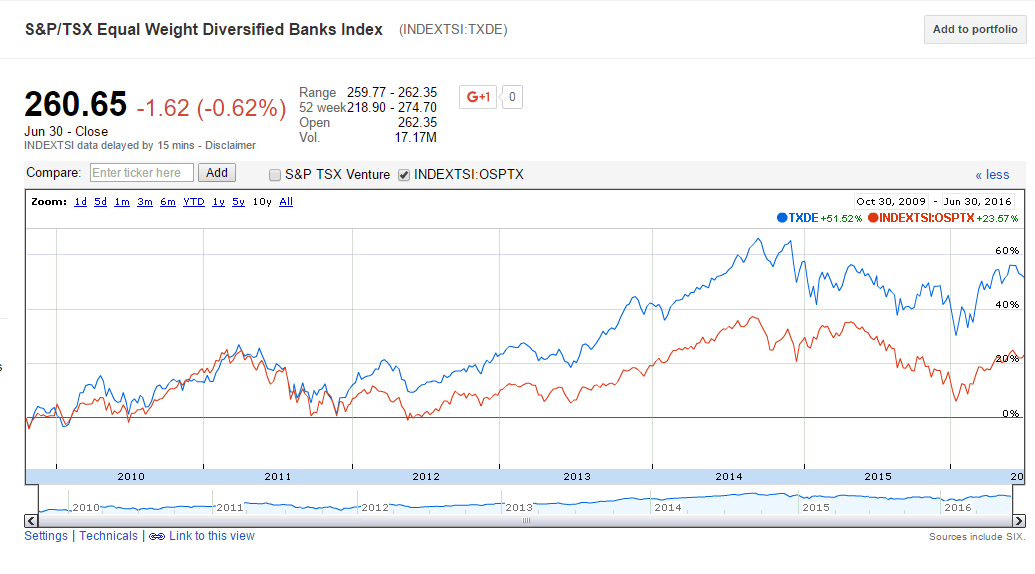

The S&P/TSX Equal Weight Diversified Banks Index is the equal-weighted version of the S&P/TSX Diversified Banks Index. The index consists of the six major Canadian banks. This index has outperformed the benchmark TSX Composite index over the 5-year and 10-year periods as shown below:

Click to enlarge

S&P/TSX Equal Weight Diversified Banks Index vs. S&P/TSX Composite Index – 5 years:

S&P/TSX Equal Weight Diversified Banks Index vs. S&P/TSX Composite Index – 10 years:

Note: The above charts show only price returns (i.e. excluding dividends).

Source: Google Finance

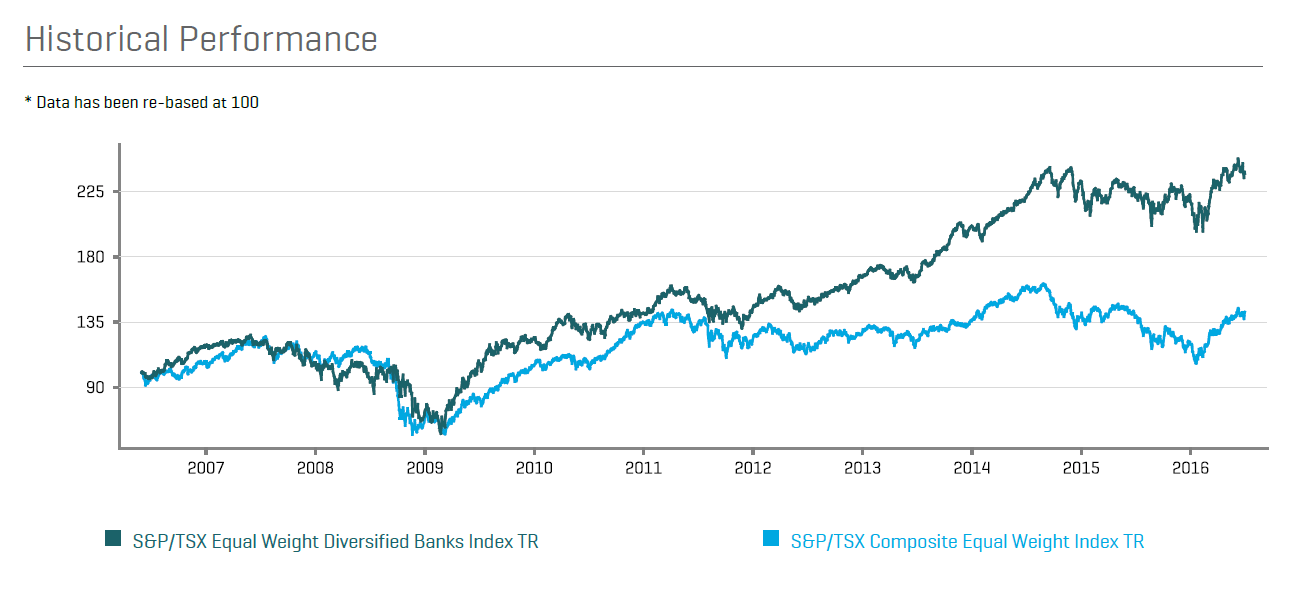

The S&P/TSX Equal Weight Diversified Banks Index vs. S&P/TSX Composite Index based on Total Returns(TR) is shown below:

Source: S&P Indices

It is not possible to invest in an index directly. So one has to invest via an ETF or mutual fund that mimics a particular index.

Some facts about the S&P/TSX Equal Weight Diversified Banks Index:

- Total Number of Constituents: 6

- The Constituents are: Bank of Montreal(BMO), Bank of Nova Scotia(BNS),Canadian Imperial Bank Of Commerce(CM), National Bank of Canada NA, Royal Bank of Canada(RY) and Toronto-Dominion Bank (TD). National Bank is not listed on the US exchanges.

- Trailing P/E as of May, 2016: 11.75

- Dividend Yield: 4.36%

Note: All figures are in Canadian Dollars

Download: Factsheet

How to invest in Canadian banks via an ETF?

The BMO S&P/TSX EW Banks Index ETF(ZEB.TO) is one ETF to gain exposure to Canadian banks. This ETF aims to replicate the performance of the S&P/TSX Equal Weight Diversified Banks Index.

Disclosure: Long BMO, BNS, CM RY, TD