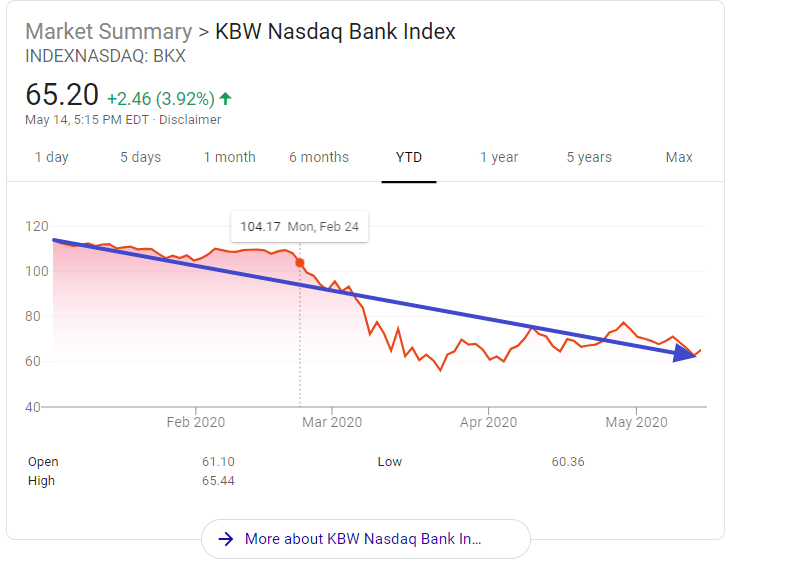

The S&P 500 is down 1.67%. The benchmark index for major US banks, KBW Nasdaq Bank Index, has declined more with a loss of 2.79% so far this year.

The chart below shows the 5-year return of the index:

Click to enlarge

Source: Yahoo Finance

Though banks are lagging the S&P 500, over the past 5 years the index has jumped nearly 50%. This is not surprising since banks were the most adversely impacted during thee financial crisis and have recovered strongly since then.

Moving forward, US banks have a better future even if the Fed raises the interest rate. Compared to a few years ago, banks are in much better shape and are reaping the rewards of asset growth and expense reductions. Currently banks are enjoying the boom in all types of lending such as auto loans, student loans, mortgages, home equity loans, credit card loans, etc. Rising interest rates should generate higher revenues and earnings. For instance, total outstanding credit card debt is reaching closer to $1.0 Trillion. When rates go higher banks will generate higher interest revenue from this debt mountain.

Hence from an investment point of view, investors can consider adding quality US banks in a phased manner. Relative to European banks US banks look attractive in terms of growth potential.

Note: You cannot invest directly in an index such as the KBW Bank Index.

Related ETFs:

- SPDR S&P Regional Banking ETF (KRE)

- SPDR S&P Bank ETF (KBE)

- Financial Select Sector SPDR Fund (XLF)

- Vanguard Financials ETF (VFH)

Disclosure: No Positions