Cigarettes are one of the most highly taxed products around the world. Equity investments in cigarette companies generally tend to payoff well in the long run as firms in the sector provide solid dividends and stable consistent growth. Successful investors have long observed the unique advantages of making money from cigarette makers. Here is a quote from Warren Buffet:

“I’ll tell you why I like the cigarette business. It cost a penny to make. Sell it for a dollar. It’s addictive. And there’s a fantastic brand loyalty.”

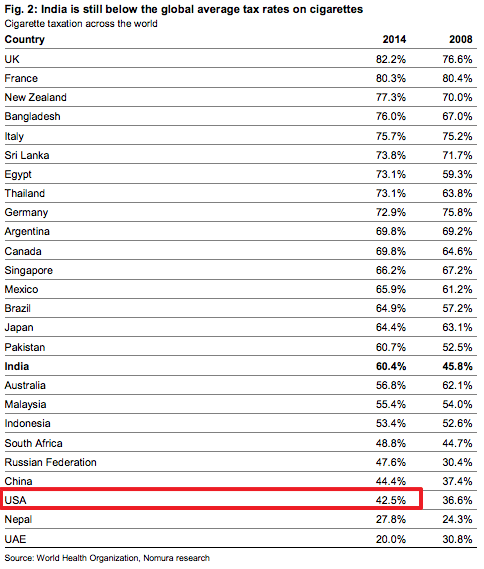

In addition to investors, states also benefit tremendously from users of this product due to taxes. In order to discourage smoking, taxes on the stuff is usually high in most countries. In the U.S. states like New York have one of the highest tax rates on cigarettes. High taxation brings in millions of dollars in revenue for the states. Globally taxes on cigarettes varies by country with the UK topping the list and the UAE charging the least with the average tax at just 20%.

The table below shows the average tax rate on cigarette by country:

Click to enlarge

Source: To protest anti-smoking measures, Indian cigarette companies are… shutting their factories?, FT Alphaville

Among the developed countries, the US has the lowest average tax rate at 42.5%.

Related posts:

- A Review of the Global Tobacco Industry, TFS

- Why Sin Stocks Are Good For Investment, TFS

- Ten Companies With Sustainable Competitive Advantages For Long-Term Investment, TFS