Gross Government Debt as a percentage of GDP gets attention when we evaluate government finances. However according an article by Patrick Love at the OECD, Net Government Debt is also an important factor to analyze in addition to Gross Government Debt. This is a valid argument since assets held by a government is also important as those assets can be sold off to pay off liabilities or can be a significant source of generating income. From the article:

In analysing the sustainability of government finances, the focus tends to be on gross government debt as a percentage of GDP. However, as gross debt does not take into account the asset side of government balance sheets, this measure only tells part of the story. Assets may generate income or be sold in order to redeem part of gross debt, and are therefore very relevant in assessing the financial health of government as well. A government with a high level of liabilities but also with significant amounts of assets on its balance sheet may be better off than a government with a lower level of liabilities and hardly any assets. Therefore, net government debt, which incorporates information on assets, constitutes a useful additional measure to gross government debt. It provides insight into the capabilities of governments to service debt in the longer run and thus presents a more comprehensive and nuanced picture of government financial health.

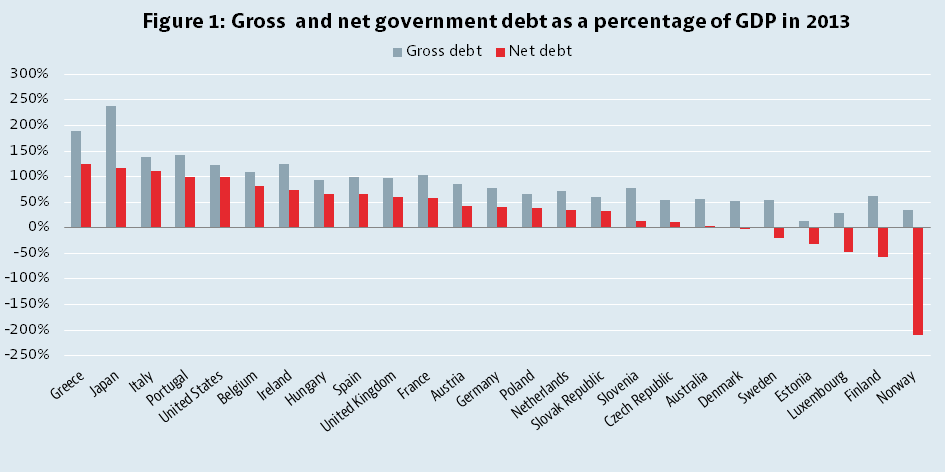

The chart below shows gross and net financial debt as a percentage of GDP in 2013 for select OECD countries:

Click to enlarge

Source: Statistical Insights: Government assets matter too, not just debt by by Patrick Love, OECD Insights

Norway, Japan, Finland, Luxembourg, Sweden, Slovenia and Greece have large amount of financial assets. So they rank lower on the basis of net vs. gross government debt. United States, Hungary, Italy, Poland, Belgium and the Slovak Republic have low financial assets on their balance sheet. Hence the difference between their net and gross government debts is not substantial.

The chart also shows the Scandinavian countries are better than other European countries based on net government debt.