Diversification in a portfolio is an important strategy for long-term success. A well-built portfolio should not be concentrated heavily on a single stock or asset class or sector. Rather a portfolio should hold various assets such as growth stocks, dividend stocks, domestic stocks, foreign stocks, commodities, ETFs, closed-end funds, bonds, etc.

Holding a diversified group of assets cushions a portfolio during rough market conditions and also provides stable and consistent returns when markets overshoot.

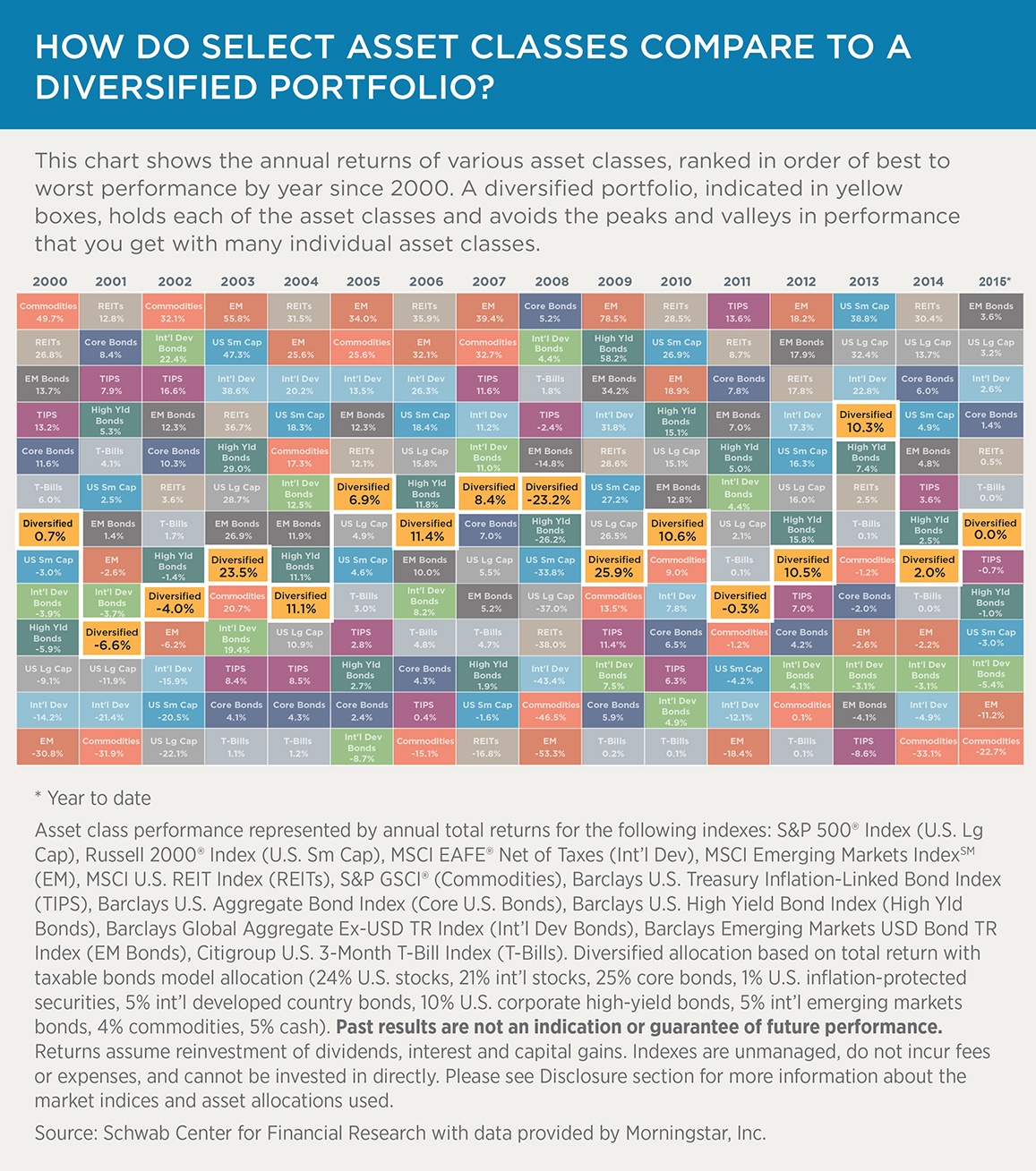

The following table shows the benefits of a diversified portfolio:

Click to enlarge

Source: Why Global Diversification Matters by Anthony Davidow, Charles Schwab

Why hold a diversified portfolio?

- More than half of the revenue from S&P 500 firms come from outside the U.S.

- The market capitalization of stocks trading overseas is higher than the market cap of US stocks.

- Thousands of stocks trade on foreign markets offering a diverse pool of stocks to choose from.