Quantitative Easing (QE) programs have been implemented by central banks of many developed countries since the Global Finance Crisis(GFC) of 2008-2009. In simple terms, the programs eases the short-term interest rate to zero or close to zero. In the US, this rate known as the Fed Funds Rate, has remained at or near zero since the programs started. This is the rate that the Fed lends funds to banks.

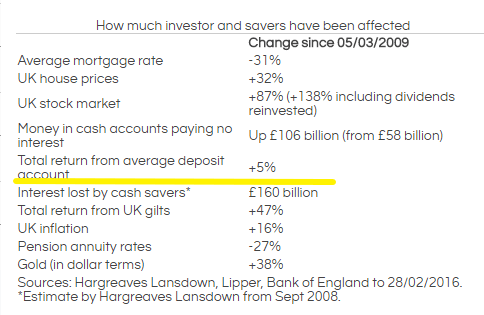

Since central banks have been lending money practically for free, interest rates on deposits have fallen to zero or near zero. This has adversely affected savers as they see their savings earn practically nothing year after year.On the other hand, borrowers and investors have done well during the same period. Here is an illustration using the UK as an example:

Click to enlarge

Source: The effects of seven years of quantitative easing by Laith Khalaf of Hargreaves Lansdown. Money Observer

Since 2009, UK savers have earned a total return of about 5% on their deposit accounts while investors in the equity market have earned 138% with dividends reinvested. Borrowers have benefited too with the average mortgage rate declining by 31%.

In the US, the average interest rate on savings accounts was just 0.56% last week according to Bankrate data. At this rate, a saver with $100,000 in a savings account would earn $560 in interest per year which will be even lower after accounting for taxes. So interest rates this low are crushing savers especially retirees and other vulnerable persons who depend on savings for steady income for expenses. Since cost of living is rising exponentially each year and average wages are declining year after year, ordinary Americans are artificially forced by the state to look for yields in places other than banks. Hence savers funnel their funds into things like the stocks, junk bonds, options, casinos, lotteries, online peer-to-peer lending, flipping houses, etc.