Volatility continues to plague global equity markets since the beginning of the year. Like clockwork, stocks are up one day only to fall the next day. One or two or even a few up days in a row seem to be the start of prolonged bull market. But alas, those dreams seem to be disappear quickly when starts decline again on a day like today due to the same old reasons like economic growth fears, oil prices, etc. So in a market like some investors may be tempted to dump stocks and then buy them at a later date when they are cheaper. Basically such investors are trying to time the market – which is next to impossible for most investors.

Here is an excerpt from an article in The Financial Post discussing the volatility of the TSX Index:

In these jumpy markets, triple-digit swings are the daily norm. Even though there aren’t many places to turn a profit these days, the pressure to generate consistently positive returns is as high as it has ever been, which has made money managers nervous and impatient.

“Investors want all these short-term gains, and that’s what’s causing all this volatility,” Brian Belski, chief investment strategist at BMO Capital Markets Corp., said in a recent telephone interview. “People are too focused on today and tomorrow, not six months from now, let alone a year from now. Nobody thinks out one year from now because they have to perform.”

This shift in mentality could be pushing shares much higher on good days and lower on bad ones.

If more people are looking to make a quick buck in stocks, losing trades will be swiftly dumped before those losses mount. And if holding periods shorten, equities will be afforded even less time to rise before an impatient trader clicks the sell key.

Source: Is the recent TSX rally the calm before the storm?, The Financial Post, Feb 23, 2016

I have written many times before about the dangers of market on this site before. I came across an informative article by Seth Masters of Alliance Bernstein on this subject. From that piece:

If you’re a long-term investor, you should be confident in two key beliefs before you act on your impulse to get out of today’s rocky stock market.

#1 You’ll Know When to Get Back In

Stock market sell-offs often seem to arrive out of nowhere. So do recoveries. Even if you time the sell decision perfectly, if you’re a long-term investor, you’ll need to buy back into the market eventually.

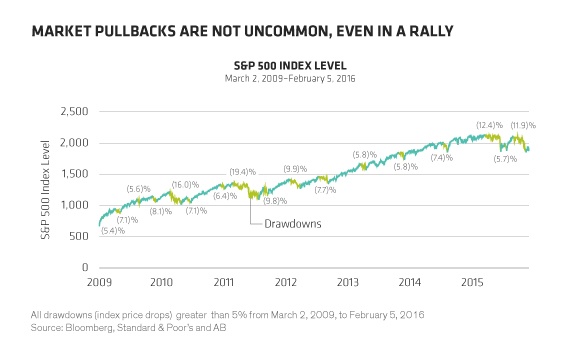

Since the market recovery began nearly seven years ago, the S&P 500 has risen about 178%. But the market’s upward climb has been punctuated by a series of pullbacks, as the Display below shows. There have been 17 different dips in which the S&P retreated by 5% or more. On average, it has taken about 31 trading days for the market to find a bottom—and about 30 trading days to reclaim the prior peak.

But recoveries aren’t marked by an “all-clear sign.” Indeed, the market often rallies despite continued investor concerns. Investors who sell during periods of market stress often feel the pain of loss twice: first, when they lock in their losses, and second, when they miss out on the eventual recovery.

Source: Think Before You Sell, Seth Masters, Alliance Bernstein, Feb 10, 2016

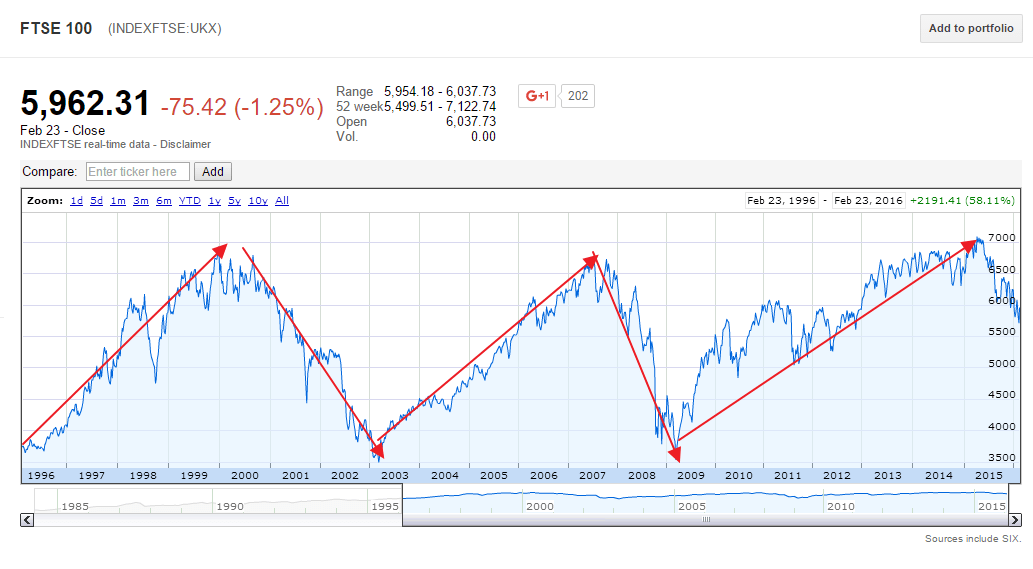

The following long-term chart shows the ups and downs of the FTSE 100 Index since 1996. Since that year, the index has grown by about 58% based on only price appreciation, If dividends re-investments are included it has more than doubled during the time period. However only those investors who have held during the rough times would have seen their investments double. An investor following the market timing strategy would have had to sold and bought back at the right times during the period time. Like Seth points out, while selling stocks may be easier, buying at the low point is not easy as there is no announcement made that says like “This is the bottom folks. Buy Stocks. Now !”.

Click to enlarge

Source: Google Finance

In summary, it is always wise to ignore short-term market movements and instead focus on the long-term return of investments. Though oil and China are getting investors’ attention these days, five years from now they would probably be put on the back burner and some other factors may determine the markets’ movements.