In equity investing, dividends are an important and substantial component of a total return.This is true especially in the long-term due to the volatile nature of stock price gains and the compounding effect of dividend re-investments on returns.

In the early 20th and entire 19th century, people invested in stocks mainly for dividend returns and not price appreciation. In the 1800s investors bought stocks mostly for earning periodic dividend payments. This practice continue well into the early 20th century. During those time, unlike today, investors did not invest in equities with the aim of selling them at higher prices.

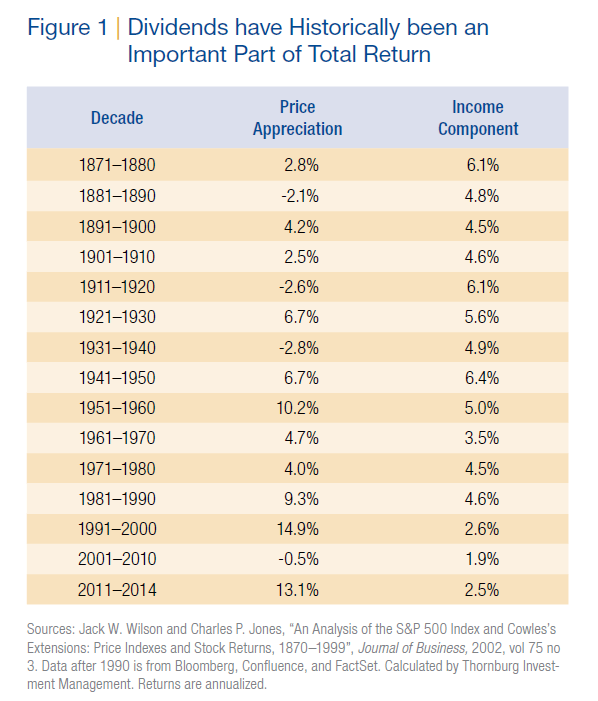

In fact, over the past 130 years thru 2014, dividends contributed more to total returns than price appreciation as shown in the table below:

Click to enlarge

Source: Cultivating the Growth of the Dividend, Thornburg Investment Management

Though the average dividend yield of the S&P 500 is around 2% it is still important to pay attention to dividends. In addition, investors should be highly cautious of non-dividend payers as investing in them is purely for price appreciation which may or may not occur. So investing in non-dividend paying stocks is not suitable for most investors.

In the “lost decade”of the 21st century, stock prices actually was flat with a loss of 0.5%. But dividends contributed 1.9% turning that loss into a net positive return for the decade. This shows the significance of dividends.