I wrote an article titled “Eight Points To Remember About Biotech Stocks” earlier this month. The following is an update to that post.

Biotech stocks have been in the news lately. The sector is inherently volatile as I explained in the above post.The dramatic decline and fall of Valeant Pharmaceuticals International, Inc. (VRX) is a classic example of the roller-roaster ride that biotech investors can expect at any time.

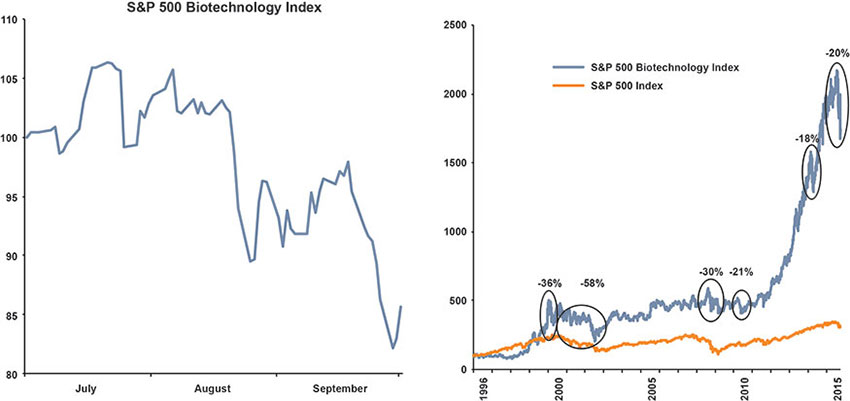

The following chart shows the return of the NASDAQ Biotech Index from 2008 thru October 16th:

Click to enlarge

Source: Chart of the week: biotech spawns a monster, MoneyWeek

According to a portfolio folio manager at Fidelity, investors can hold biotech stocks for the long-term. However Rajiv Kaul, the manager of Fidelity® Select Biotechnology Portfolio correctly advises investors to consider investing only a small portion of their assets in biotechs. From the article:

Biotech stocks have hit a rough patch in recent weeks. The S&P 500 Biotech Index has fallen around 20% since its high point July, as investors have grown worried about the impact China could have on global growth, and the potential for regulatory policy changes that could affect drug pricing.

Rajiv Kaul, the manager of Fidelity® Select Biotechnology Portfolio, thinks that the market may be misreading the potential impact these risks could have on biotech stocks. He has been using the recent pullback as an opportunity to upgrade the quality of the names in his fund, and still believes that biotech’s five-to-10-year investment story remains compelling and may warrant a small place in a diversified portfolio, but only for investors who can live with the potential ups and downs.

The above chart shows the gut-wrenching volatility of biotechs in the past.

Source: Biotech: Bubble or opportunity?, Fidelity

The entire article at Fidelity is worth a read as it makes many interesting points some of which I noted in my article linked above.

Disclosure: No Positions