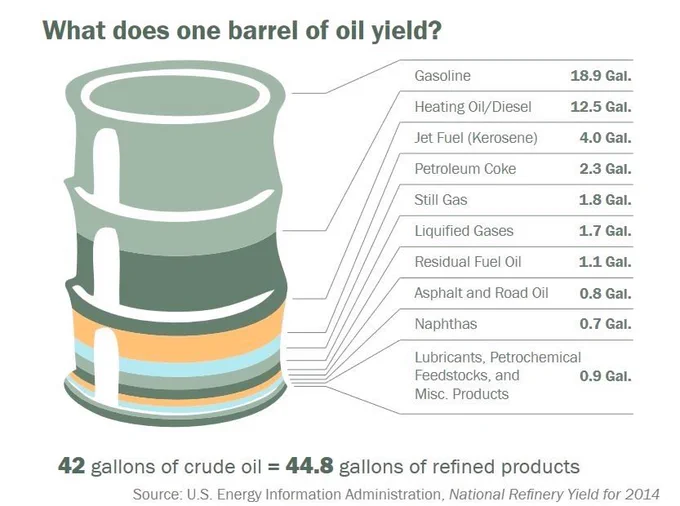

Lower crude oil prices benefit some countries while others suffer. Similarly cheap oil helps some sectors more strongly than others. For example, airlines and shipping firms benefit heavily as they are direct users of large amounts oil.

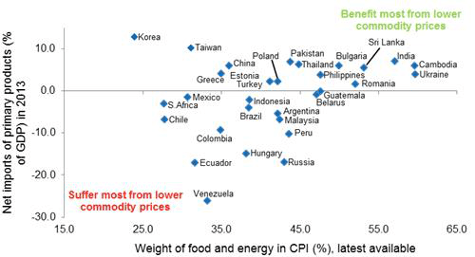

It is not just crude oil that has declined dramatically in the past few months. Other commodities such as palm oil, copper, iron ore, coffee beans, etc. have also plunged by substantial percentage points. The chart below shows the winner of lower commodity prices (not just crude oil):

Click to enlarge

Source: Nomura Global Markets Research, October 2014 via Emerging market exodus by Maike Currie in Money Observer, Aug 20, 2015

Among the BRICs, Brazil and Russia are losers since both are big exporters of oil, iron ore, agricultural products, natural gas, etc. On the other hand, India and China are winners since both countries are net imports of oil and other commodities. Lower copper prices hurts Chile as the country is the largest exporter of copper in the world.

Lower commodity prices have a net zero impact on Mexico. Though Mexico is a big oil exporter, the Mexican economy also is well diversified with manufacturing and tourism being two other major sectors. So the negative effects of lower oil prices does not adversely impact Mexico than other such as Colombia, Venezuela or Russia.