Dividend returns account for a significant part of total returns especially over the long-term in many markets. So it is important to hold dividend-paying stocks in the portfolio. Even a small dividend yield can amplify returns die to the effect of compounding.

How much do dividends contribute to performance? In this post lets take a look at three global regions.

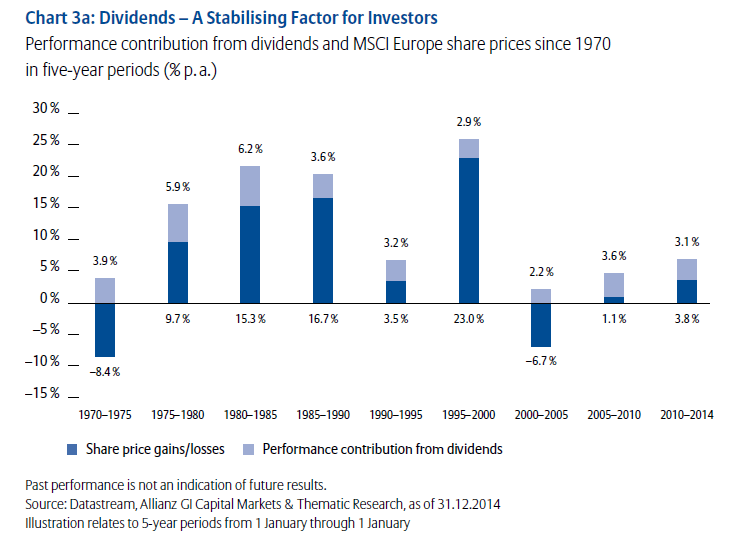

1) Europe:

Click to enlarge

Dividends have consistently produced a positive return to European stocks since 1970 as shown above. They accounted for 39% of the total returns for the entire period shown in the chart. This is indeed substantial . During periods of stock price declines dividends have helped investors offset the losses. As European companies generally tend to have high payouts, Europe offers a fertile hunting ground for investors looking for income stocks.

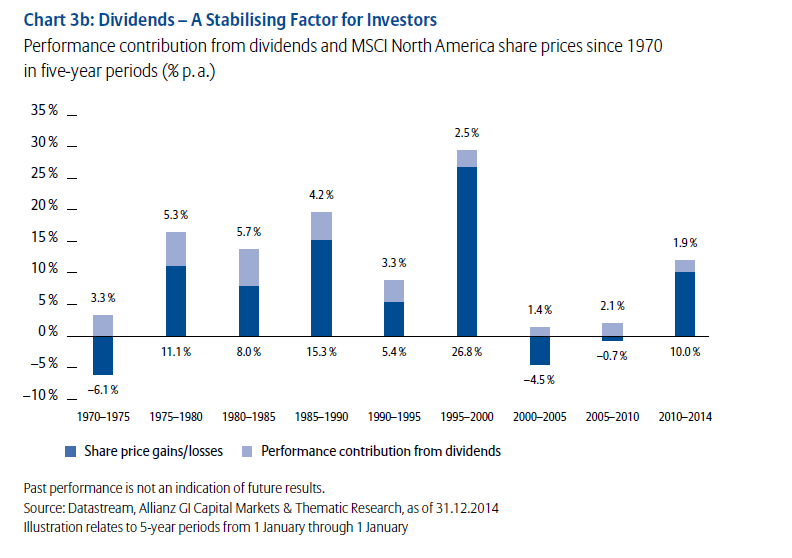

2)North America:

In North America also one-third of the returns came from dividends. Though the payout ratio in the U.S. is lower than in Europe, one advantage is that companies have room to raise the payouts should they decide. As large-cap U.S. firms are flush with cash this should not be an issue.

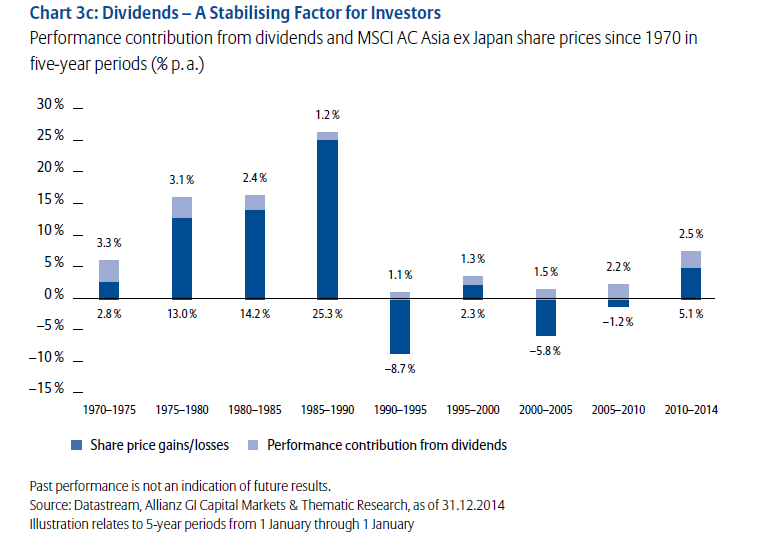

3) Asia excluding Japan:

Dividends accounted for more than one-third of the total returns in Asia as represented by the MSCI AC Asia ex Japan Index. The definition of this index from MSCI:

The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The MSCI AC Asia ex Japan Index consists of the following 10 developed and emerging market country indexes: China, Hong Kong, India, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand.

Source: Dividends instead of low interest rates, March 2015, Allianz Global Investors

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions