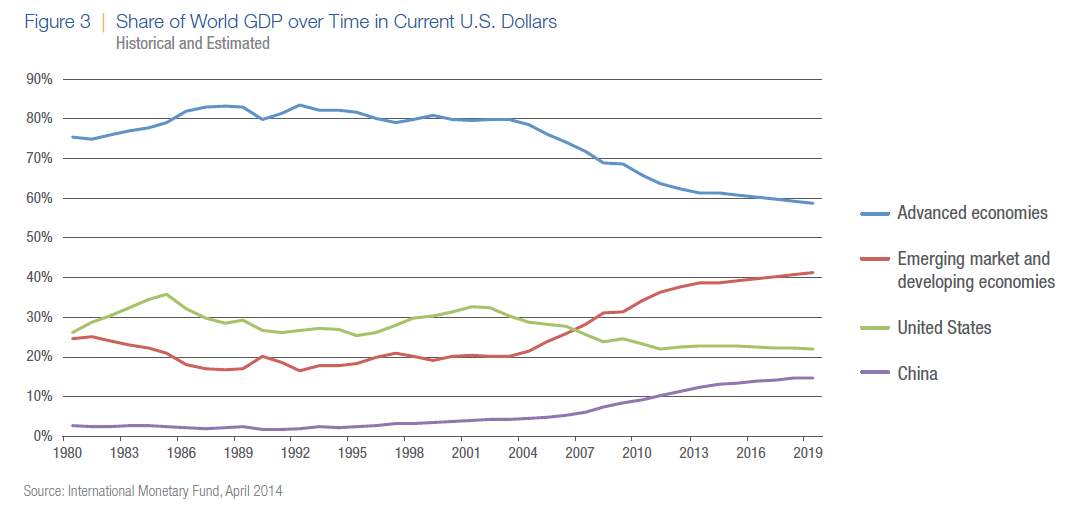

The U.S. share of global economic output continues to decline. Last year it stood at just 22% of the world GDP while the share of emerging economies is growing. This is another reason for U.S. investors to diversify and include foreign stocks in their portfolios. Currently most U.S. investors have low allocations to international stocks due to the effect of “home bias”.

Click to enlarge

Source: Margin of Safety, Tactical Rebalancing and Strategic Allocation in Overseas Equities, Feb 2015, Thornburg Investment Management

From the research report:

Although the United States still boasts the globe’s biggest economy and deepest capital market, the world has rapidly evolved over recent decades. Back in 1970, the U.S. share of global stock market capitalization stood at a towering 66%, according to MSCI. At the end of June 2014, its share amounted to just under half the total. Meanwhile, the U.S. share of global economic output stood at 26% in 1980, while that of emerging markets and developing countries was 25%, and China’s just 2.8%.3 Fast forward to 2014, and the U.S. share has shrunk to an estimated 22%, while emerging markets and developing countries now account for some 39% of world gross domestic product, and China’s economy has since grown almost five-fold to 13% of global GDP (Figure 3).

The entire report is an interesting read.