The U.S. economy is officially considered a free-market economy. However in reality, many sectors of the economy are dominated by a handful of monopolies and oligopolies. For example, the tax preparation industry is dominated major players like TurboTax (owned by Intuit), H&R Block and TaxAct.

The U.S. is one of the few countries in the world that have laws in place to prevent companies from monopolizing the market. The Sherman Antitrust Act was enacted in 1890 for this purpose.It has been used many times since then to breakup monopolies. However in the 20th and 21st centuries breaking up monopolies has become harder even with this law on the books.

Here is a short quote on The Sherman Antitrust Act from Wikipedia:

The Sherman Antitrust Act (Sherman Act,[1] 26 Stat. 209, 15 U.S.C. §§ 1–7) is a landmark federal statute in the history of United States antitrust law (or “competition law“) passed by Congress in 1890. It prohibits certain business activities that federal government regulators deem to be anti-competitive, and requires the federal government to investigate and pursue trusts.

It has since, more broadly, been used to oppose the combination of entities that could potentially harm competition, such as monopolies orcartels.

According to its authors, it was not intended to impact market gains obtained by honest means, by benefiting the consumers more than the competitors. Senator George Hoar of Massachusetts, another author of the Sherman act, said the following:

“… [a person] who merely by superior skill and intelligence…got the whole business because nobody could do it as well as he could was not a monopolist..(but was if) it involved something like the use of means which made it impossible for other persons to engage in fair competition.”[2]

The Act’s reference to “trusts”, and to “antitrust” law in general, is sometimes misunderstood by modern readers. In 19th century America, the term “trust” was synonymous with monopolistic practice, because the trust was a popular way for monopolists to hold their businesses, and a way for cartel participants to create enforceable agreements.[3] In most countries outside the United States, antitrust law is known as “competition law“, instead.

Source: Wikipedia

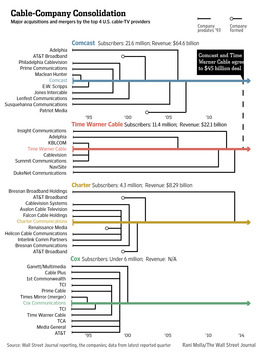

I have written about the monopolistic nature of the U.S. Airline and Railroad Industries before. Along the similar lines this post is related to the Cable TV industry. Just like so many other industries, just four big companies control the majority of the cable TV market in the U.S. As a result, they are able to dictate prices in the markets they control and customers are forced to endure atrocious customer service.

In Feb 2014, Comcast(CCV), one of the biggest cable companies announced plans to buy Time Warner Cable(TWC) for $45 billion. The deal has to be approved by the FCC and the U.S. Department of Justice. Time Warner had about 11 million subscribers and Comcast had about 33 million subscribers last year. So the combined company, if the deal is approved, will be able to control a substantial share of the cable TV market.

The graphic below shows the evolution of the four major cable companies:

Click to enlarge

Source: Cable Company Got Its Price, With Tradeoffs, Feb 13, 2014, The Wall Street Journal

Disclosure: No Positions