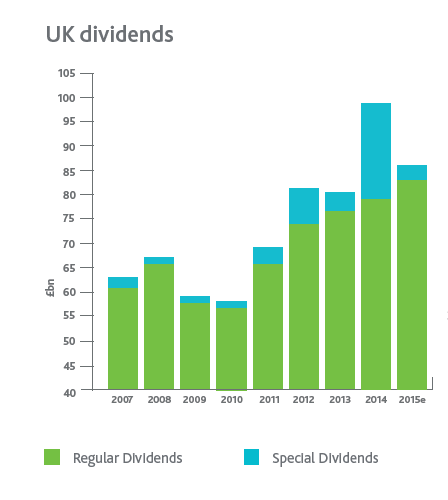

Capita Asset Services of UK published their latest edition of Dividend Monitor report yesterday. They forecast the headline dividend payouts of up to £86.1bn this year. In 2014, UK companies paid out £97.4bn in dividends up 21.0% from the previous year. Some of the key points from the report include:

- “Special dividends distort true picture as underlying dividends rise just 1.4%, weakest growth since 2010

- Sterling’s early 2014 strength knocked £3.5bn off full year total

- Q4 shows improvement, with 4.0% underlying growth fastest since Q3 2013 as currency effects start to reverse on strengthening US dollar

- Tesco cancellation of dividend to cost investors £900m, but 2015 outlook is brighter

- Capita revises forecasts headline payouts up to £86.1bn in 2015

- Underlying total to climb by 5.7% to £83.6bn”

Source: 2014 Dividends Weaker Than Feared But UK Investors Feel Benefit Of Stronger, Jan 26, 2015, Mondovisione

The chart below shows the yearly growth of dividends since 2007:

Click to enlarge

Source: Capita Asset Services

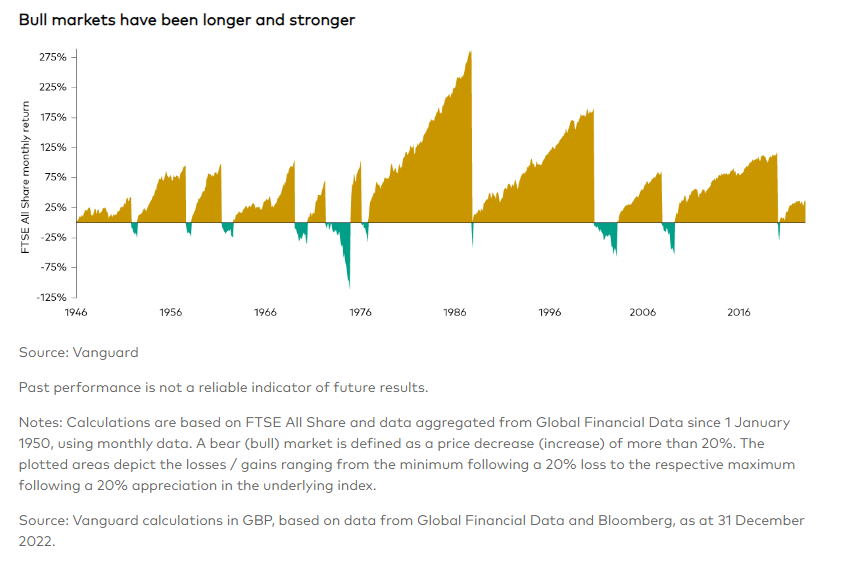

According to a note by Citi, UK firms have paid out higher dividends since the financial crisis and they predict the trend will continue. The chart below shows the UK dividend payout ratio since 1965:

Click to enlarge

Source: Why equities are at their cheapest in 100 years, Interactive Investor

Currently British firms have a dividend yield of about 3.5% compared to just around 2% for the S&P 500. The FTSE 100 is up 4.4% year-to-date as of Jan 26 relative to the S&P 500 which is basically flat so far this year.

British stocks also offer an added advantage for US investors as there there is no dividend withholding tax except for REITs.

Investors looking to gain exposure to British stocks can consider the following ten companies:

1.Company: Unilever PLC (UL)

Current Dividend Yield: 3.46%

Sector: Food Products

2.Company: HSBC Holdings PLC (HSBC)

Current Dividend Yield: 5.18%

Sector: Banking

3.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 4.25%

Sector:Tobacco

4.Company: Royal Dutch Shell PLC (RDS.A)

Current Dividend Yield: 5.66%

Sector: Oil, Gas & Consumable Fuels

5.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.05%

Sector: Wireless Telecom

6.Company: AstraZeneca PLC (AZN)

Current Dividend Yield: 3.97%

Sector: Pharmaceuticals

7.Company: BP PLC (BP)

Current Dividend Yield: 6.17%

Sector: Oil, Gas & Consumable Fuels

8.Company:SSE PLC (SSEZY)

Current Dividend Yield: 6.25%

Sector:Multi-Utilities

9.Company: National Grid PLC (NGG)

Current Dividend Yield: 4.92%

Sector:Multi-Utilities

10.Company: Rolls-Royce PLC(RYCEY)

Current Dividend Yield: 2.67%

Sector: Aerospace & Defense

Note: Dividend yields noted above are as of Jan 27, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions