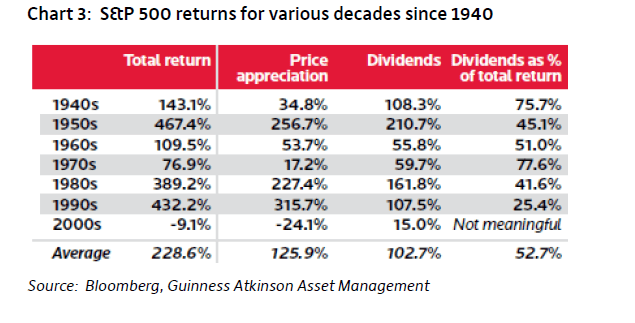

Dividends account for a significant portion of the total returns of the S&P 500 over long periods. The table below shows the contribution of dividends to the total returns of the S&P 500 over the decades since 1940:

Click to enlarge

Source: A Brave New World, Dec 2014, The Absolute Return Letter, Absolute Return Partners

It is surprising to note that during the 1940s and 70s dividends accounted for 75-80% of the total returns. These two decades were also characterized by slow economic growth. So it can be argued that during periods of slower GDP growth dividends play a much more important role in total returns.

During the 90s many U.S. firms slashed their dividend payouts as investors preferred share price growth than dividends. Also the bull market of that decade made dividends almost “meaningless” as stock prices were soaring on a consistent basis.Up until the 1970s, dividends contributed at least 45% to the total returns in each of the decade shown.

It would be interesting to see how much dividends end up contributing to total returns at the end of this decade.

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

Disclosure: No Positions