Germany’s benchmark equity index DAX plunged last month over fears of slow economic growth. From 9,454 the index fell to as low as 8,354 for a fall over 11%. However it recovered strongly from the depth of the lows and closed at 9,326 in October.As of Nov 10th, the DAX is down by 2.1% year-to-date while the S&P 500 is up by 10.3%.

Investors in German equities panicked in October based on some published economic data including surveys.Generally survey data are not reliable and investors should not react information based on surveys. This is because surveys are fatally flawed in many ways. For example, surveys can generate very different answers from participants based on how a question is posed to them.

Here are a few summary points from an article titled “Why You Should Avoid German Equities” by Andrew Sachais, posted on Oct 15th in Seeking Alpha:

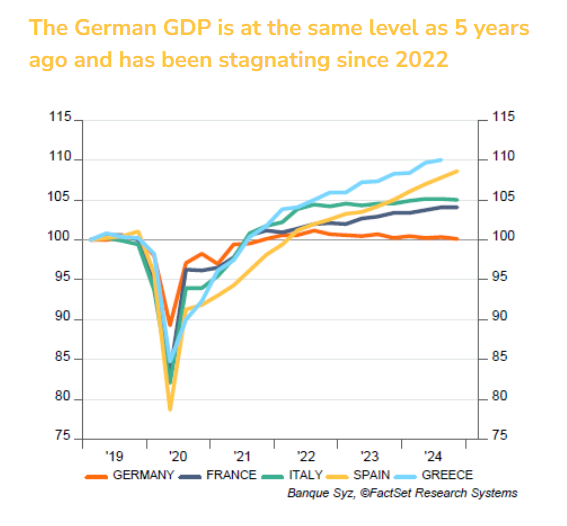

German economic sentiment reached multi-year lows in October.

Sentiment in the region has deteriorated alongside industrial production and inflation measures.

Continued economic weakness signals that investors should flee German equities.

One of the charts the author used to in the article support his theory is the German ZEW index which is created based on a survey. As I noted above one should not make the decision to buy or sell stocks based on surveys. One of the commentators to the article correctly noted that the ZEW is a”nonsense indicator”.

Another article titled “Germany’s Dark Future” by Frances Coppola painted a scary future for the German economy.

Natixis released a special report on Oct 13th, with the aptly named title “Germany: Don’t panic!”. The following is the summary of the report:

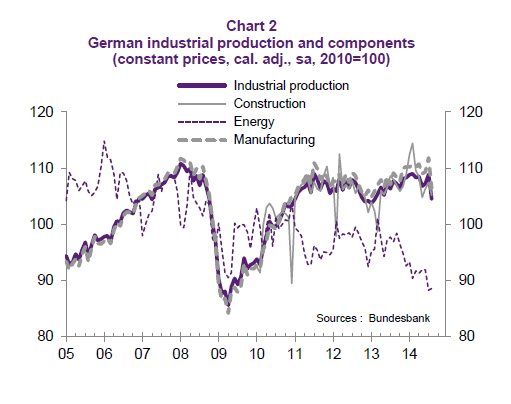

The recent disappointing industry data has increased the worries over the German economy heading into a technical recession in the third quarter, after a mild contraction of -0.2% QoQ in Q2. While August’s weak hard data and falling sentiment confirmed that the German economy is losing some steam, we do not expect the German economy to fall back into recession. Due to technical factors, industry data for September should rebound. Overall, given that Germany’s domestic economy is fundamentally strong, we think that fears over a hard landing for Germany are overstated.

Natixis noted that Germany’s disappointing industry data in August is likely exacerbated by shifts in holidays.

Click to expand

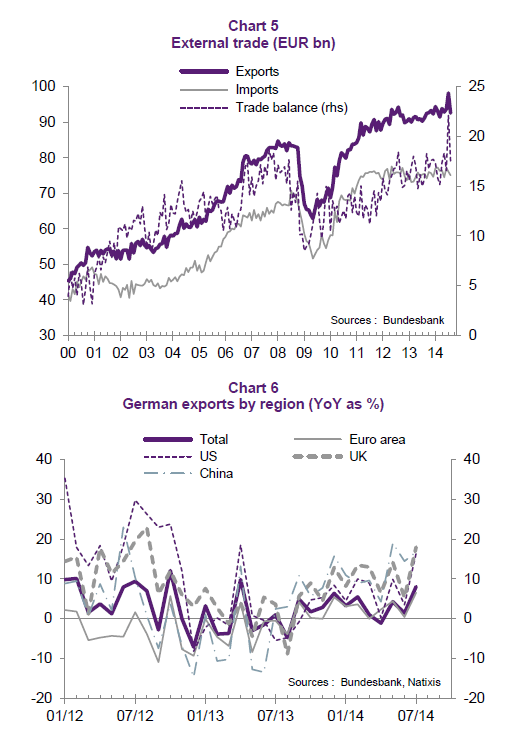

Since the Germany is an export-based economy it is important to focus on export data. The report had a positive take on exports:

German exports slumped -5.8% in August, adding to the disastrous picture of Germany’s gloomy industry data seen in the last week (chart 5). However, again, adverse effects from late school holidays should have played a non-negligible role in the sharp decline in German exports in August. In fact, exports were strong in the previous month, showing a monthly gain of +4.8%. This, together with a favourable carry-over growth, took exports +2.0% above the Q2 average up to now. At the same time, the outlook for Germany’s exports is encouraging. So far, Germany’s exports to major trading partners outside the euro area held up well (chart 6) and a lower euro should act as a boost to German exports, although a lower exchange rate will need some time to feed through.

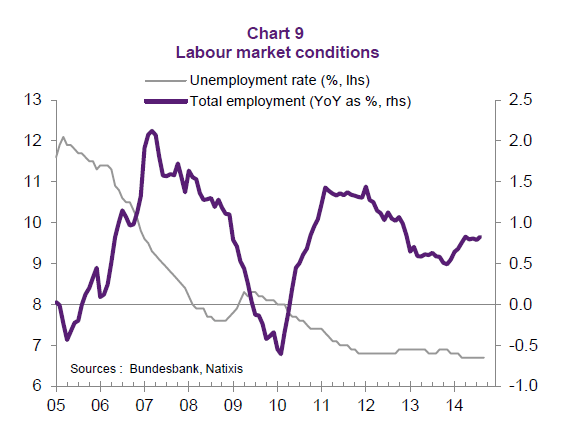

The German domestic economy is fundamentally strong as workers enjoy rising income, low inflation and low unemployment rate.The unemployment rate stood at just 5.0% in September. The following chart shows the strong labor market:

Source: Germany: Don’t Panic, Special Report, Natixis, Oct 13, 2014

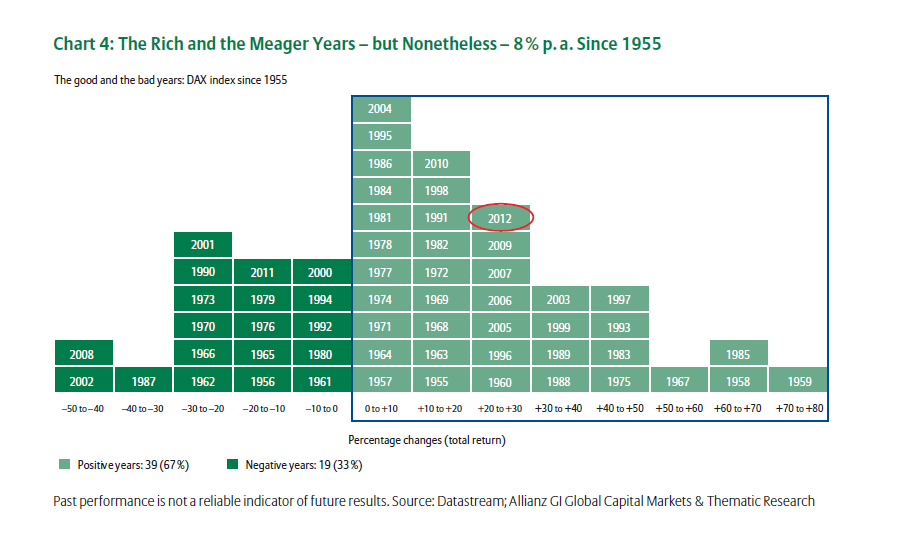

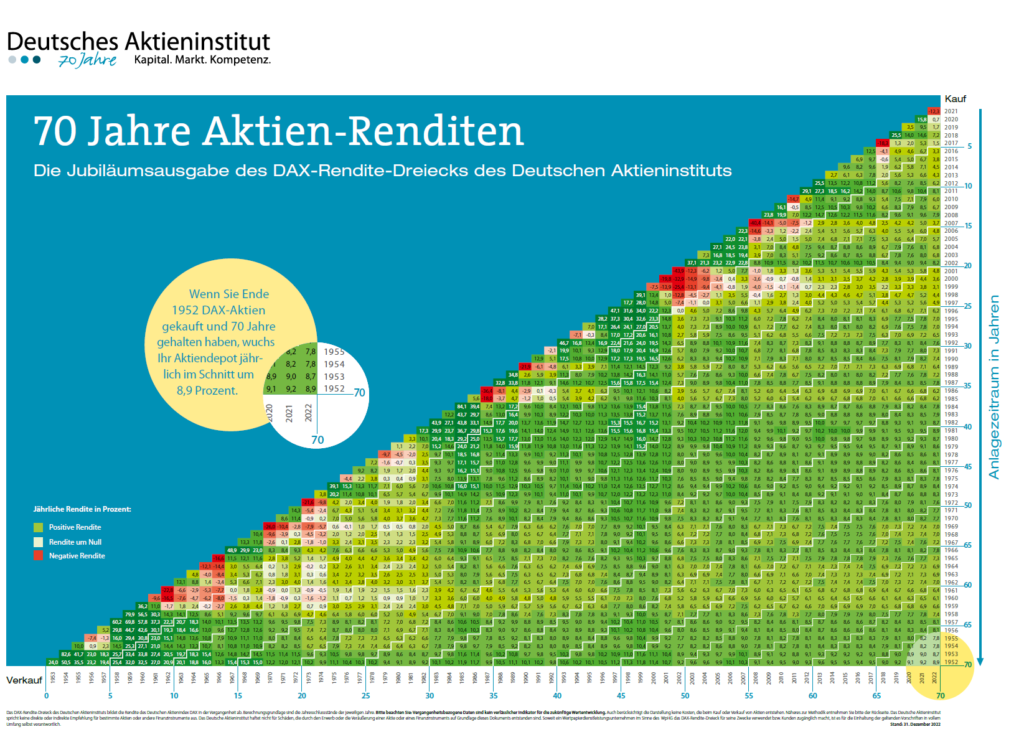

Despite the short-term economic fluctuations investors in should stay clam and hold German stocks for the long-term.Instead of panicking investors are better of taking advantage of lower stock prices by adding high-quality stocks to their portfolios in phases. The long-term performance of German stocks has been excellent in the past as evidenced by the chart below:

Click to enlarge

Source: 25 Years of the DAX:Wealth for Everyone, Allianz Global Investors

From an article I wrote back in in January “Since 1955 the returns have been mostly positive in the vast majority of the years. In 39 years the returns were positive compared to 19 years in which returns were negative.”.

Related ETFs:

- iShares MSCI Germany (EWG)

Disclosure: No Positions