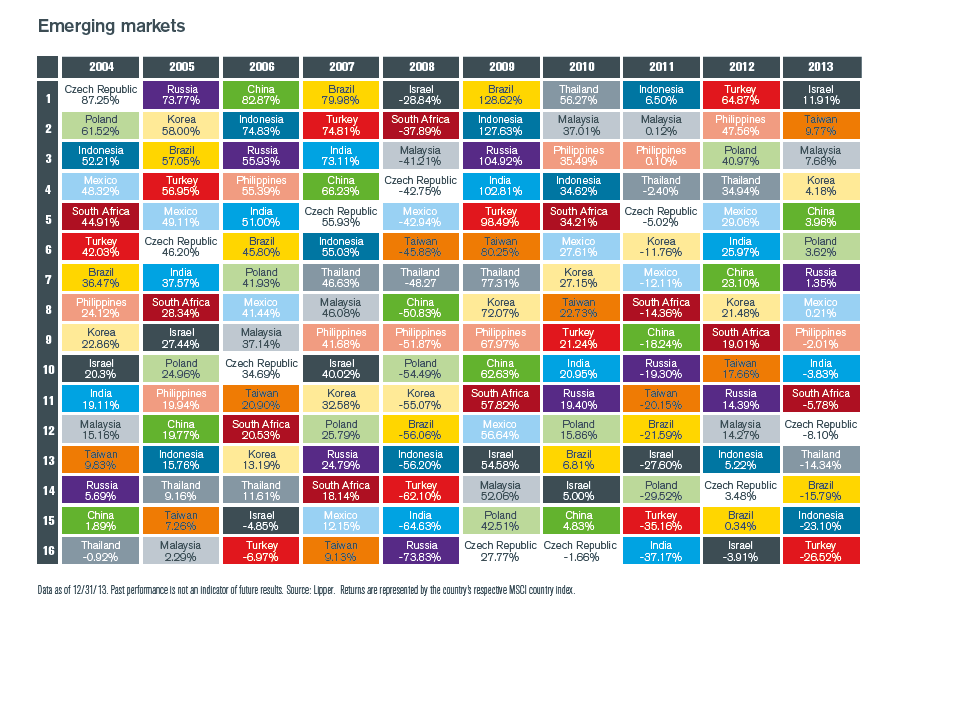

Yesterday we looked at the comparison of US returns against other developed markets. In this post lets take a look at the emerging market returns by country over the past 10 years.

Click to enlarge

Source: Henderson Global Investors

Note: The returns shown above are based on the country’s respective MSCI country index.

A few observations from the above chart:

- Brazilian stocks soared with the boom in the commodity markets up until 2007. Then in 2008 during the global financial crisis stocks plunged over 56%. Since 2010 Brazilian stocks have performed poorly.

- China has performed better in the past 3 years than Brazil.

- Except in 2008 and 2013, Indonesian stocks have yielded solid returns every year.

- Similarly, Poland has been one of the top performing markets market emerging and East European markets.

- Overall no country has been the top performer in two consecutive years.

Related ETFs:

- iShares MSCI Indonesia Investable Market Index ETF (EIDO)

- iShares MSCI Brazil Index (EWZ)

- Market Vectors® Russia ETF (RSX)

- iShares MSCI South Africa Index Fund (EZA)

- iShares FTSE/Xinhua China 25 Index Fund (FXI)

Disclosure: No Positions