The S&P 500 is up 3.13% and 4.78% year-to-date in terms of price and total returns respectively. Total return is higher since it includes dividends. The index has given up much of the gains recently from the peak reached earlier this year as markets around the world have become extremely volatile due to a variety of issues including worries about global growth, interest rate increase by the Federal Reserve, Ebola virus, Ukraine crisis, ISIS, Syria, oil prices, global warming, German exports, China slowdown, collapse of commodity prices, lack of public sighting of North Korean leader Kim Jong Un, Catalonia’s independence from Spain, Hong Kong protests, Russian economy and so forth.

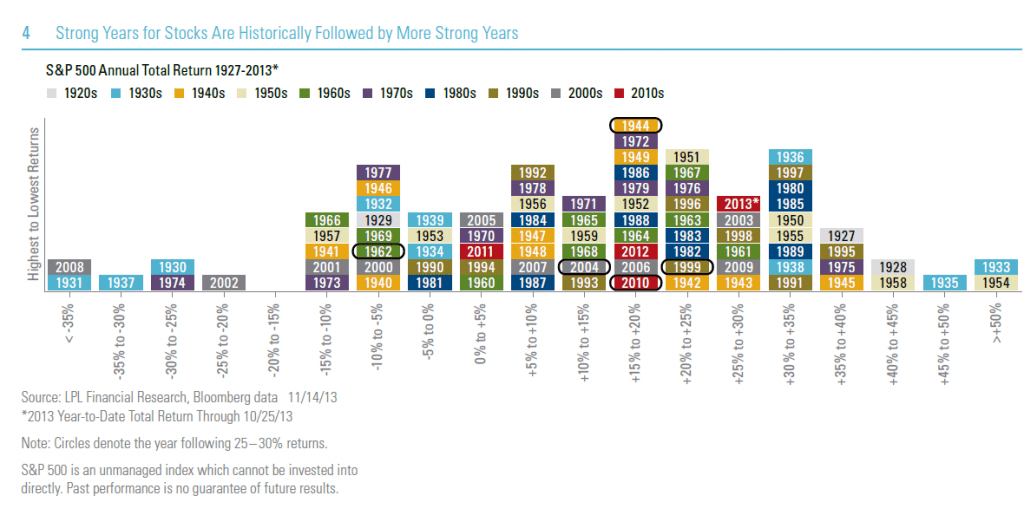

In 2013, the S&P soared by a staggering 30%. When dividends are included the return was even higher at 32.39%. After that strong run up last year and the return of volatility with a vengeance, many investors may be wondering if the rest of the year will bring further correction in stock prices. Such worries may be misplaced. According to a research report by LPL Financial, strong returns in equities are historically followed by more strong years. Hence though stocks are going through violent swings now it might as well turn out to be another strong year for the US market.

Click to enlarge

Source: Outlook 2014, LPL Financial

From the research report:

Some may fear an outsized gain in the stock market during 2013, is surely to be punished with losses in the coming year. However, historically after a one-year total return in the 25 – 30% range, the S&P 500 has followed it up by more solid years of gains. In fact, the average return in a year following a 25 – 30% gain was 12%, and stocks posted a double-digit gain in four of the five occurrences (the exception was 1961’s gain of 26.9%, which was followed by a loss of 8.7% in 1962) [Figure 4]. In fact, most of the years were actually followed by several years of strong gains, as was the case in 1943,2003, and 2009.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions