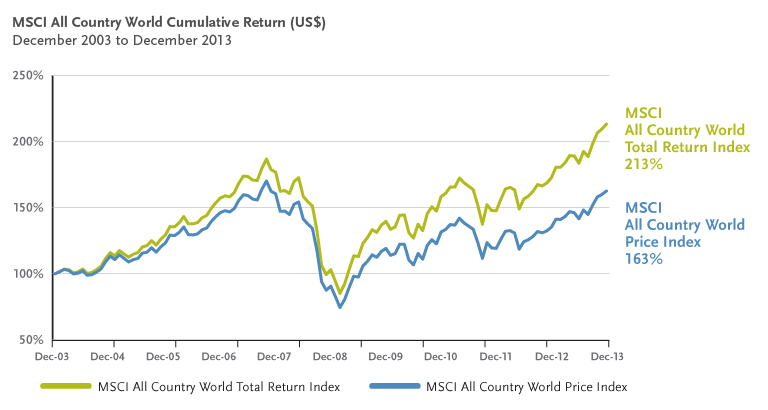

Dividend-paying stocks can implify returns in the long run due to the effect of compounding. The total return is boosted by reinvesting dividends in addition to any returns due to price aprpeciation. Generally the longer the longer the holding period the higher the return. Stocks that grow dividends yield even higher returns due to the above process. So investors are better off investing in high-quality dividend payers and growers than simply investing for price appreciation.

The chart below shows the total return and price return of MSCI All Country World Index over the past 25 years:

Click to enlarge

Source: AGF Global Dividend Fund, AGF Management Limited

The Top 10 stocks from the MSCI World High Dividend Yield Index are listed below for further research and potential investment:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.08%

Sector: Food Products

Country: Switzerland

2.Company: Novartis AG (NVS)

Current Dividend Yield: 3.06%

Sector: Pharmaceuticals

Country: Switzerland

3.Company: Roche Holding AG (RHHBY)

Current Dividend Yield: 3.01%

Sector: Pharmaceuticals

Country: Switzerland

4.Company: Total SA (TOT)

Current Dividend Yield: 4.68%

Sector: Oil, Gas & Consumable Fuels

Country: France

5.Company: Johnson & Johnson (JNJ)

Current Dividend Yield: 2.76%

Sector: Pharmaceuticals

Country: USA

6.Company: Chevron Corp (CVX)

Current Dividend Yield: 3.49%

Sector: Oil, Gas & Consumable Fuels

Country: USA

7.Company: Pfizer Inc (PFE)

Current Dividend Yield: 3.51%

Sector: Pharmaceuticals

Country: USA

8.Company: AT&T Inc (T)

Current Dividend Yield: 5.19%

Sector: Telecom

Country: USA

9.Company: Merck & Co Inc (MRK)

Current Dividend Yield: 3.04%

Sector: Pharmaceuticals

Country: USA

10.Company: Royal Dutch Shell PLC (RDS.A)

Current Dividend Yield: 4.78%

Sector: Oil, Gas & Consumable Fuels

Country: UK

Note: Dividend yields noted above are as of May 29, 2014. Data is known to be accurate from sources used. Please use your own due diligence before making any investment decisions.

Disclosure: No Positions