Emerging market equities have traditionally been considered for price appreciation as opposed to their income potential.As the name implies, emerging firms are highly attractive from the growth perspective since they have plenty of room to grow domestically and internationally in order catch-up with their developed world peers. However investors may be overlooking the fact that emerging equities can also be attractive candidates for dividend income. This is because dividend culture is slowly gaining traction in many emerging markets. South African firms have had a strong dividend-paying culture for a long time.Latin American companies are also embracing the concept of rewarding shareholders with dividends. Some Asian markets have historically been supporters of dividend payments and others are slowly starting to follow too.

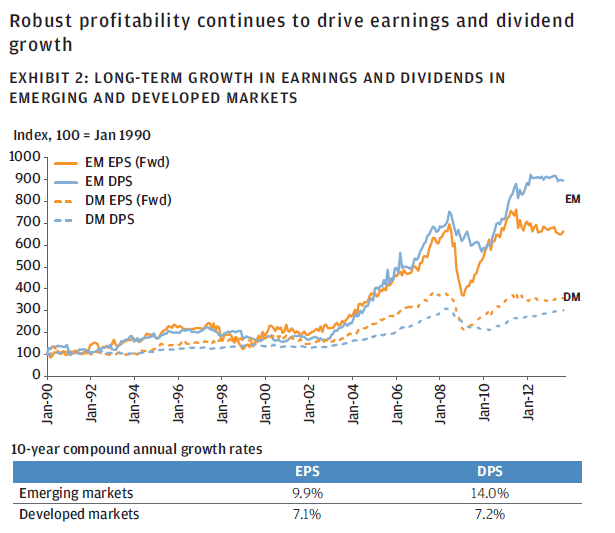

One way to analyze emerging markets for dividend opportunities is using the dividend per share (DPS) metric.According to a Investment Insights report by J.P. Morgan,UK DPS growth in emerging markets has been higher than in developed markets over the years as shown in the chart below:

Source: Total EM income: Maximising the EM income opportunity set, J.P. Morgan Asset Management, UK

From the report:

Exhibit 2 shows the long-term growth in dividends and earnings for the MSCI Emerging Markets Index vs. the MSCI World. The fact that emerging markets have consistently delivered higher growth in earnings per share (EPS) than the developed world is perhaps not a surprise. However, what many investors may have overlooked is that dividend per share (DPS) growth has been higher than developed world DPS growth and has also outpaced EM EPS growth. We believe these trends are sustainable as increased RoE allows the higher growth of emerging markets to be translated into profits.

As emerging companies continue to grow further their earnings should increase leading increased dividend payouts. Higher and rising dividends can help investors generate a superior total return over the long-term is higher due to the effect of compounding by reinvesting dividends.

The key to investing in emerging markets for income is to stay focused and ignore short-term volatility like the one we experienced late last year and earlier this year. Emerging markets are prone to higher volatility due to political issues, currency exchange rate gyrations, sudden outflow of foreign capital and so forth.Wise investors do not make knee-jerk reactions to these events but remind themselves of the original reason they decided to invest in emerging markets in the first place. Emerging markets are not the place for risk-averse investors.

Ten dividend stocks from ten emerging countries are listed below for consideration:

1.Company: Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 2.48%

Sector: Banking

Country: Brazil

2.Company: Standard Bank Group (SGBLY)

Current Dividend Yield: 4.57%

Sector: Banking

Country: South Africa

3.Company: Ecopetrol SA (EC)

Current Dividend Yield: 7.61%

Sector: Oil, Gas & Consumable Fuels

Country: Colombia

4.Company: Coca-Cola Femsa SAB de CV (KOF)

Current Dividend Yield: 2.15%

Sector: Beverages

Country: Mexico

5.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 1.83%

Sector:Independent Power Producers & Energy Traders

Country: Chile

6.Company: Chile Mobile (CHL)

Current Dividend Yield: 4.19%

Sector: Wireless Telecommunication Services

Country: China

7.Company:Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 2.24%

Sector: Semiconductor

Country: Taiwan

8.Company: Malayan Banking Berhad (MLYBY)

Current Dividend Yield: 5.94%

Sector: Banking

Country: Malaysia

9.Company: Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 4.83%

Sector: Mobile Telecom

Country: Philippines

10.Company: Creditcorp Ltd (BAP)

Current Dividend Yield: 1.94%

Sector: Banking

Country: Peru

Note: Dividend yields noted above are as of Feb 21, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long ITUB