Emerging equity markets are having another bad year so far. Some of the emerging market currencies such as the Russian Ruble, Turkish Lira, Argentina Peso, etc. fell heavily this week adversely affecting the stocks markets. As investors fled the emerging markets, developed markets also followed especially this week. Argentina is one of the main initiators of the recent emerging market panic. Unlike last year Argentine stocks have performed poorly this year. Though Argentina seemed to have turned a corned last year, it now appears it is headed for more trouble this year.

Ten reasons to avoid Argentine stocks this year are noted below:

- Inflation is the second highest in Latin America after Venezuela. It is estimated to reach around 30% this year.Though the official rate was around 11% in December, 2013 everyone believes that number is cooked up by the government.

- Argentines have lost faith in the state.According to a recent poll, 62% disapprove of way the government handles the economy.Nearly three-fourths disapprove of the government’s handling the inflation and crime. On the global level, investors have not restored their faith and trust in Argentina for years.

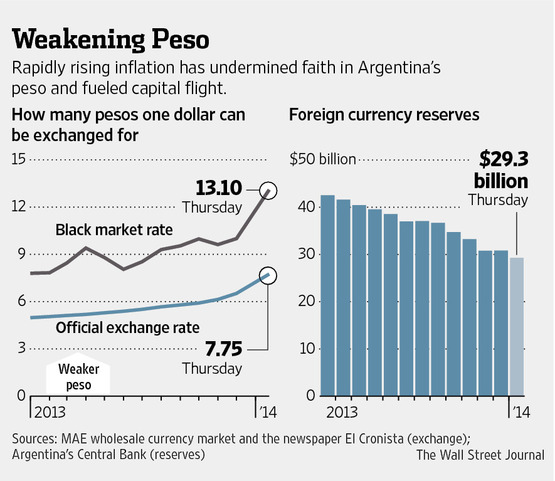

- The Argentine currency Peso is in shaky if not freefall mode.

- Foreign currency reserves has been decreasing since last year as shown in the chart below: Click to enlarge

- As a commodity-dependent economy Argentina’s finances are unlikely to improve unless commodity prices rise. Unlike Brazil and Chile, the country is particularly dependent on agricultural commodities such as soya beans.

- The state’s intervention in the workings of the market and the economy is extremely high. Price controls and currency management by the Central Bank have only made the situation worse. Actions such as nationalization of private companies have made foreign investors avoid the country like the plague.

- Government spending is very high and is likely to continue until the president Cristina Fernández de Kirchner is out of the office.

- The government has failed to stop capital flight and foreign investment flows into the country.

- The current dividend yield for Argentina equities is 1.3% and the P/E ratio is 4.2. Brazil and Chile have yields of 4.3% and 3.0% respectively. The P/E for Brazil and Chile are 13.0 an d 17.1 according to FT market data. Obviously the low P/E for Argentina means the country is not an attractive market to invest now.

- Economic growth this year is projected to be very modest this year.IMF projects the real GDP to grow to by just 2.8%.

Sources: In Argentina, a Populist Formula Goes Flat, The Wall Street Journal, Jan 24, 2014 and others as linked

Most of the Argentina ADRs are in the negative territory this year. The Global X FTSE Argentina 20 ETF (ARGT) is down about 15%.

The table below shows the year-to-date performance of Argentine ADRs trading on the US exchanges:

| S.No. | Company | Ticker | Stock Price on Jan 24, 2014 | YTD % Change | Industry |

|---|---|---|---|---|---|

| 1 | Alto Palermo | APSA | $22.10 | 4.94% | Real Estate Inv&Serv |

| 2 | Tenaris | TS | $44.33 | 1.46% | Indust.Metals&Mining |

| 3 | Edenor | EDN | $5.10 | 0.79% | Electricity |

| 4 | Transportadora de Gas del Sur | TGS | $1.98 | -8.76% | Oil & Gas Producers |

| 5 | BBVA Banco Frances | BFR | $6.30 | -9.48% | Banks |

| 6 | Ternium | TX | $28.33 | -9.49% | Indust.Metals&Mining |

| 7 | Cresud | CRESY | $9.11 | -9.80% | Food Producers |

| 8 | Telecom Argentina | TEO | $15.09 | -12.47% | Mobile Telecom. |

| 9 | Nortel Invesora | NTL | $17.25 | -13.32% | Mobile Telecom. |

| 10 | IRSA Inversiones y Representaciones | IRS | $10.10 | -16.60% | Real Estate Inv&Serv |

| 11 | Banco Macro | BMA | $19.85 | -18.21% | Banks |

| 12 | Petrobras Argentina S.A. | PZE | $4.50 | -18.92% | Oil & Gas Producers |

| 13 | Pampa Energia | PAM< | $4.15 | -20.80% | Electricity |

| 14 | Grupo Financiero Galicia | GGAL | $8.15 | -22.01% | Banks |

| 15 | YPF | YPF | $23.02 | -30.16% | Oil & Gas Producers |

Source: BNY Mellon

Disclosure: Long BMA

Related:

Argentina is going down (MoneyWeek)

8 bizarre things that only happen in emerging market Argentina (FinancialPost)