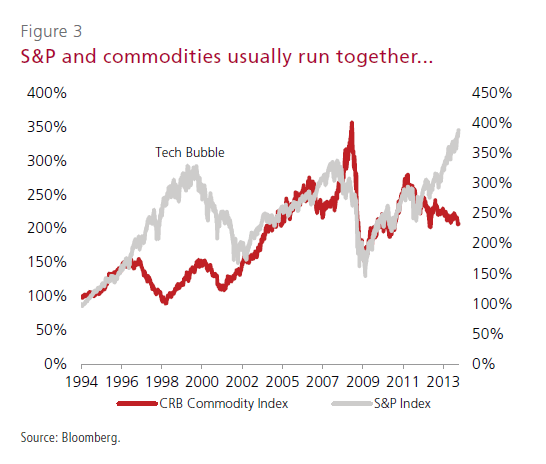

When the S&P 500 index rises commodities usually follow. Commodities, as represented by the CRB Commodity Index and the S&P 500 run generally higher based on economic growth expectations.

From the lows of 2009, S&P’s strong rebound coincided with a run up of commodities. However after 2012 the S&p 500 and CRB commodity Index started to diverge in their performance. While the S&P 500 has continued to rise higher commodities have declined for almost two years in a row.

However CIBC is optimistic on commodities and the mining sector in particular moving forward.

Click to enlarge

Source: A Look to the Future – 2014 Edition, CIBC World Markets

From CIBC’s “A Look to the Future – 2014 Edition” report:

The big divergence in the late 90’s saw the bursting of the Tech Bubble but the current run in the S&P could be pointing to commodities being priced too low. Alternatively, commodities, and hence mining shares may well offer a very good investment hedge against a possible pullback in the S&P. This view is further backed by very clear evidence across the mining space of sharp reductions in capital expenditure and aggressive reductions in future output growth.

Related ETFs:

Disclosure: No Positions