Emerging equity markets are lagging the performance of developed markets this year. The year-to-date price returns as of May 31st of some of the major emerging and developed indices are listed below:

- S&P 500: 14.3%

- UK’s FTSE 100: 11.6%

- France’s CAC 40: 8.4%

- Germany’s DAX: 9.7%

- China’s Shanghai Composite: 1.4%

- India’s Bombay Sensex: 1.7%

- Brzail’s Sao Paulo Bovespa: -12.2%

- Chile’s Santiago IPSA: -4.8%

- Mexico’s IPC All-Share: -4.0%

As economic growth in China slowed and the demand for commodities decreased in the past few months, emerging markets which are dependent on commodity exports were deeply affected. Other factors such as high inflation, fiscal issues, political instability, slow progress of economic reforms, lackluster economic growth, labor issues, etc. have negatively impacted the performance of emerging markets such as India, Russia, Mexico, South Africa, etc.

More recently the currencies of emerging countries have experienced sharp declines with rising fear of a meltdown in the equity markets. So far the plunge in currency prices has not severely hit the equity markets of these countries.

From a May 31st article by Ambrose Evans-Pritchard in The Telegraph:

South Africa’s rand punched through the psychological barrier of 10 to the dollar as investors flee countries with big current account deficits, deemed most at risk. The country’s central bank said it would take action to stem the fall in the rand if moves became “abrupt and disorderly”.

The Johannesburg Stock Exchange says foreigners have withdrawn €1.1bn (£940m) from South African bonds over the past 10 days. The Turkish lira fell to the lowest in 17 months against the dollar, though it has just been upgraded to “investment” quality by Moody’s. The Thai baht fell to a one-year low, a pattern seen in much of emerging Asia.

Bond yields have spiked sharply in Turkey, South Africa, Mexico and Hungary, rippling through down corporate spreads. Yields on 10-year Polish bonds have jumped 60 basis points to 3.60pc in May as even the strongest are drawn into the turmoil. “This is the end of the bull market,” said Benoit Anne from Societe Generale. “I am now throwing in the towel. We are out of virtually all our emerging market bonds.”

Mr.Ambrose noted that of the $8.0 Trillion foreign capital invested in these markets outflows have been tiny so far.

Source: South African rand leads emerging market rout, The Telegraph, May 31, 2013

An article in Bloomberg today echoed similar sentiment on the state of emerging markets. From the article:

The worst month in a year for emerging-market currencies will prove to be more than a momentary bout of weakness to strategists at firms from UBS AG to Societe Generale SA who see the Federal Reserve weaning investors off its extraordinary stimulus.

South Africa’s rand led declines among the 24 developing-nation currencies tracked by Bloomberg last month, tumbling 11.3 percent. JPMorgan Chase & Co.’s Emerging MarketsCurrency Index (FXJPEMCI) fell 3.3 percent, the most since it slipped 7 percent in May 2012. Only China’s yuan gained, rising 0.51 percent.

“For these emerging-market currencies, this is the beginning of a trend that perhaps is going to be longer and deeper in terms of a correction,” Tom Levinson, a currency strategist in Londonat ING Groep NV, the largest Dutch financial-services firm, said in a May 31 phone interview.

Source: Emerging Market Dominoes to Fall as SocGen Sees Rout, Bloomberg

I recently came across an interesting article by emerging markets guru Mark Mobius of Franklin Templeton Investments. He discussed the results of a 2013 Global Investor Sentiment Survey (GISS) conducted by his firm and the case for emerging markets. The key findings of the survey:

According to the GISS, 58% of investors residing in developed markets believe their local stock market will be up this year, but investors in emerging markets were even more upbeat – 66% believed their local stock market would post a bullish performance in 2013. Similarly, investors residing in emerging markets expected higher returns on their investments, with an average return expectation of 12% this year and 18% over the next 10 years. Those in developed markets expected a 7% average return in 2013, and 10% over the next 10 years.

Supporting his theory on emerging markets, he quoted three important factors:

- Developed countries are projected to grow by just 1.2% this year compared to emerging market’s growth of 5.3% according to the IMF. Mark anticipates this trend to continue in the coming years also.

- Emerging markets have foreign reserves higher developed markets.

- The ratio of public debt to GDP has been declining in emerging markets while it has been increasing in the developed world.

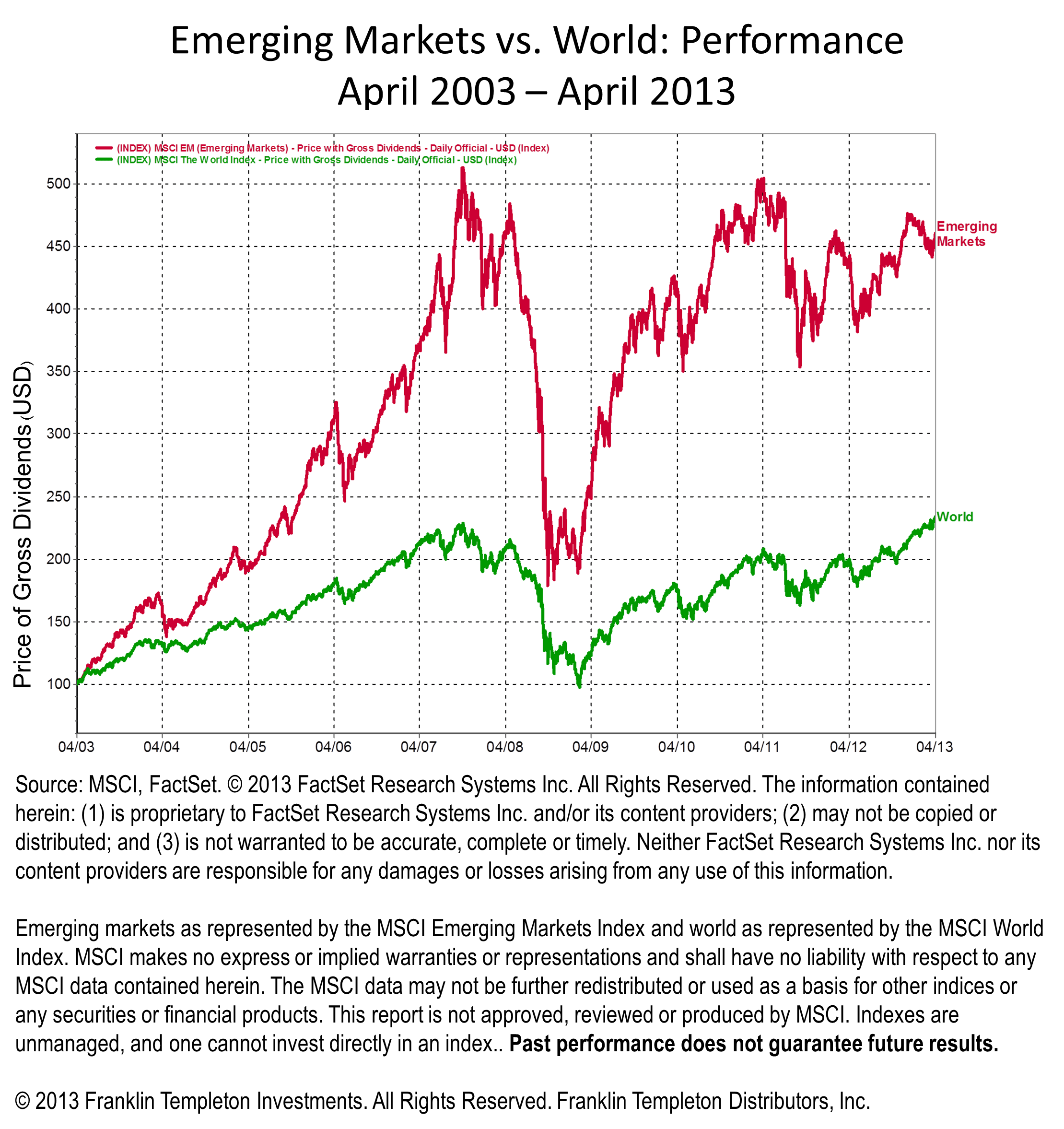

The following chart compares the performance of Emerging Markets against Developed Markets using the respective MSCI indices (Price with Gross Dividends in US $ terms):

Click to enlarge

Source: Investors Living in Emerging Markets are a Bullish Bunch!, Investment Adventures in Emerging Markets, Franklin Templeton Investments

Though their equity markets have soared, most countries in the Europe and even the U.S. are not completely out of the woods yet. For example, though unemployment rate is declining in the U.S. the pace of job growth is not robust yet as employers are still reluctant to take risks. Similarly most governments across the pond seem to be mired in policy paralysis unable to find meaningful solutions to the problems plaguing their economies. Though outside of the Euro zone, the British government has not fixed the banking system despite giving billions in bailouts at the depth of the financial crisis.

Developing countries have many positive factors including the rise of middle class, growing consumption of goods and services, rising wages, etc. in addition to the ones mentioned by Mr.Mark Mobius above. Hence investors need not completely avoid these countries despite the current turmoil. Investments in the mining sector can be avoided. However sectors closely tied to the domestic economy such as banking, consumer goods, utilities, oil, etc. can be considered for potential opportunities.

To get started, ten emerging market stocks from ten different countries with their current dividend yields are shown below:

1.Company: Vina Concha y Toro (VCO)

Current Dividend Yield: 1.78%

Sector: Beverages

Country: Chile

2.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 2.33%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

3.Company: Sanlam Limited (SLLDY)

Current Dividend Yield: 5.05%

Sector: Insurance

Country: South Africa

4.Company: HDFC Bank (HDB)

Current Dividend Yield: 0.70%

Sector: Banking

Country: India

5.Company: Telekomunikasi Indonesia (TLK)

Current Dividend Yield: 2.49%

Sector: Telecom

Country: Indonesia

6.Company: China Petroleum & Chemical (SNP)

Current Dividend Yield: 4.21%

Sector: Oil and Gas Producers

Country: China

7.Company:Coca-Cola FEMSA S.A.B de C.V. (KOF)

Current Dividend Yield: 0.82%

Sector:Beverages

Country: Mexico

8.Company: Ecopetrol SA (EC)

Current Dividend Yield: 6.36%

Sector: Oil and Gas Producers

Country: Colombia

9.Company: Malayan Banking Berhad (MLYBY)

Current Dividend Yield: 3.20%

Sector: Banking

Country: Malaysia

10.Company: Gazprom (OGZPY)

Current Dividend Yield: 7.39%

Sector: Oil and Gas Producers

Country: Russia

Note: Dividend yields noted are as of May 31, 2013. Data is known to be accurate from

sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions