Lloyds Banking Group (LYG) and Royal Bank of Scotland(RBS) are two of the top five banks based in the U.K. Both these banks used to have solid dividend yields and performed well up until the credit crisis of 2008-09 hit. In order to prevent the banks from collapsing due to heavy losses the British government stepped in and bailed these “Too-Big-To-Fail” banks. Even though many years have passed since the rescue these two banks have yet to return to profitability. Royal Bank of Scotland has been the worst performed compared to Lloyds Bank.

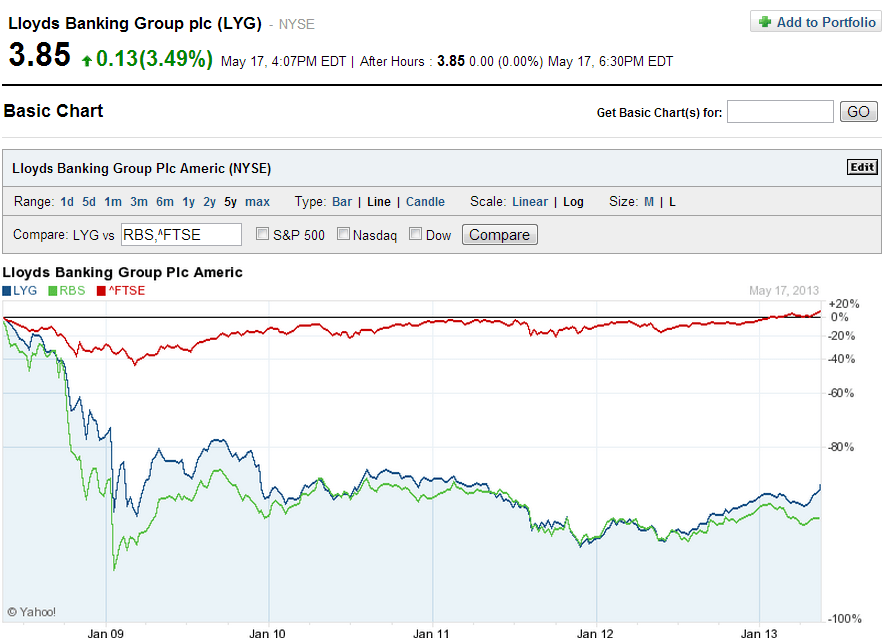

Here is a five-year chart showing the performance of the two banks against FTSE 100:

Click to enlarge

Source: Yahoo Finance

Lloyds Bank is up about 20% so far this year based on positive developments such as increasing lending and expectations to post a profit this year. It should be noted however that the bank is 39% owned by the British government. Since the share price has increased and is getting closer to the price paid at the time of bailout, the state may dump its stake at any time. Hence investors need not get too excited about buying shares at the current levels. Llyods has also not reinstated its suspended dividend payments since it hasn’t earned a profit and has not repaid the state.

Founded in 1727, Edinburgh-based Royal Bank of Scotland(RBS) seems to have lost its conservative roots during the bubble years.Currently the state owns 81% of the bank. On Friday the ADR closed at $10.33. But that price is a bit misleading since the company implemented a reverse split in the ratio of 1:20 in late 2008. The stock has fallen heavily from around $16.00 after the split to the current price. RBS also has not paid a dividend since 2009.

Disclosure: Long LYG