China is a net creditor nation and the U.S. is a the world’s largest net debtor nation. The Chinese are the largest holders of U.S. Treasury securities with total holdings exceeding $1.2 Trillion as of January this year. Every year the U.S pays billions of dollars as interest for this debt to China.

According to an article by Visiting Professor John Ross of Antai College of Economics and Management, Jiao Tong University, Shanghai states that China’s financial strength is unparalleled. From the article:

To grasp the underlying dynamic of the global financial industry it should be grasped that it is a mistake to understand the strength of China’s economy by statistics such as that China produces as much steel as the next 38 countries combined, more cement than the rest of the world put together, that it is the world’s largest market for TVs, refrigerators, mobile phones, cars, or that it has more than twice as many internet users as the US. These figures are impressive but far from illustrating the real core of China’s economic power. The real center of China’s economic strength, which determines both its domestic and global expansion, is unparalleled financial strength.

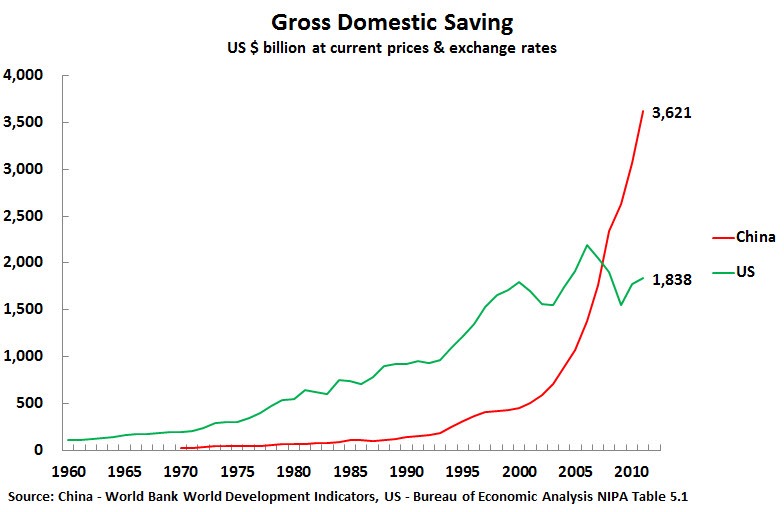

China has yet to overtake the US in GDP but the annual sum of China’s finance available for global or domestic investment, that is its savings, are already twice those of the US. As Figure 1 shows China’s savings in 2011, the last year for which there are comprehensive figures, were $3.6 trillion compared to $1.8 trillion in the US.

Click to enlarge

Source: China – the World’s Emerging Financial Superpower, Key Trends in Globalisation

But savings are the ‘raw material’ of the financial system. It is this huge flow passing through China’s banking system which is making China the world’s ‘financial superpower’. China’s $3.3 trillion foreign exchange reserves, easily the world’s largest, are a powerful adjunct but it is the year after year generation of domestic finance on a scale which has no international parallel which is the unmatched core of China’s economic strength.

To see the dynamic this is creating in the global finance industry it is useful to give a comparison of the main indices for China’s and the US’s banks – 2013’s figures, when they are published, will further reinforce these trends.

US banks reporting in 2012 were still ahead of China’s on revenue – $550 billion compared to $404 billion, and on assets – $10,079 billion compared to $9,895 billion. But on profits China’s banks had already overtaken their US competitors – $105 billion compared to $68 billion. China’s banks also held the lead in stock market valuation – $992 billion to $847 billion.

At the beginning of 2013, by market capitalization both China (ICBC, China Construction Bank, Agricultural Bank of China, Bank of China), and the US (Wells Fargo, J.P. Morgan Chase, Citigroup, Bank of America) had four out of the world’s top ten banks by market capitalization. But the total valuation of the Chinese banks was $706 billion compared to the US $620 billion. China’s ICBC is the world’s largest bank by both profit and capitalization.

In other financial fields – insurance, mortgage lenders, credit cards etc – the US still maintains a lead over China. But in core banking strength there is already essentially no difference between China and the US.

Chinese banks are increasingly becoming more powerful at the global level. A review of the Top 1000 Global Banks for 2012 published by The Banker magazine shows that Chinese banks accounted for just 4% of global profits in 2007 but in 2012 they accounted for about one-third of total global profits. Among the Top 1000 China’s ICBC took the third position – the highest ever spot for a Chinese bank. In addition, Chinese banks took four positions among the top 10 banks.

More importantly, among the top 25 banks by profits, the top three were banks from China. The most profitable three banks in the ranking were ICBC, China Construction Bank(CICHY) and Bank of China. The fifth position went to Agricultural Bank of China(ACGBY). US-based JP Morgan Chase(JPM) was ranked the fourth.

At a household level, China’s personal saving rate at more than 50.0 percent was the highest in the world in 2012. The U.S. savings rate at was under 4.0 percent for most the year.

With high savings rate and low consumption China’s gross domestic savings is bound to rise. On the other hand, as a consumption-based economy the U.S. is unlikely to catch up with China in the savings area quickly.

Hence in summary it may not be far-fetched to say that China is the World’s Financial Superpower.

Disclosure: No Positions