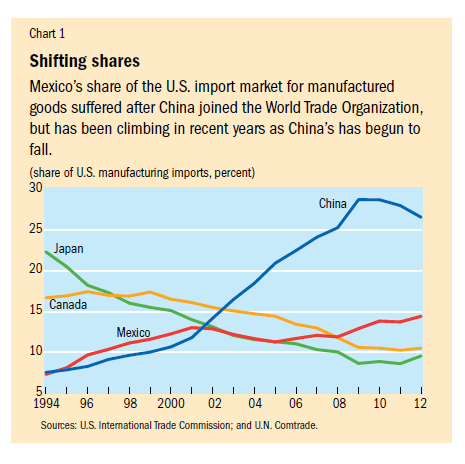

Mexico’s economy boomed when the country signed the North American Free Trade Agreement (NAFTA) nearly two decades ago. The manufacturing sector especially thrived as U.S. firms shifted their operations to Mexico to take advantage of the cheap labor costs. As a result Mexico’s share of U.S. manufactured goods import rose from slightly about 4% in 1994 to about 13% in 2001 according to a report in the latest issue of IMF’s Finance & Development magazine.

Then the party almost came to a halt when communist China joined the World Trade Organization (WTO) in 2001. China’s entry into the WTO gave the country a strong edge over over Mexico since China could freely export its goods to the U.S. without any import restrictions. Hence China’s goods exports to the U.S. rose significantly while Mexico’s exports suffered.

From the report:

Between 2001 and 2005, Chinese manufacturing exports to the United States expanded at an average annual rate of 24 percent, while Mexico’s export growth decelerated sharply from about 20 percent a year to 3 percent on average each year over the same period. As a result, China’s share of U.S. manufacturing imports almost doubled by 2005, eroding the previous gains in market share by Mexico (see Chart 1).

Click to enlarge

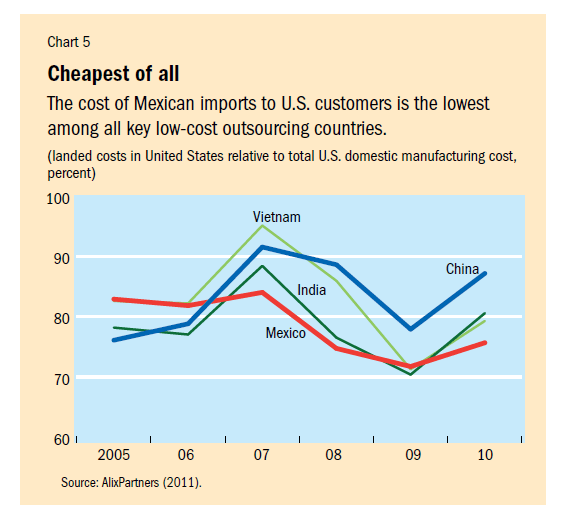

In recent years Mexico has been slowly regaining its lost manufacturing capacity as U.S. firms shift production to the country from China and other countries. This shift can be attributed to two reasons: labor cost and transportation cost.

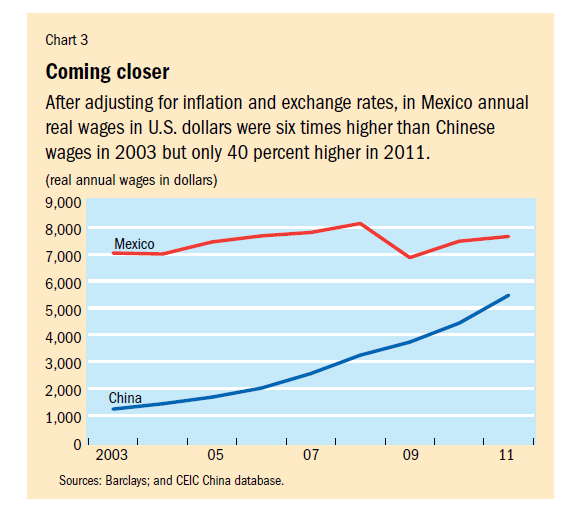

The above chart shows that wages in China are rising yearly and is getting closer to Mexican wages. Wages in the manufacturing sector in Mexico has remained fairly stable over the years while wages in China has been increasing. So China is becoming less competitive for U.S. firms.

Another factor that makes Mexico more attractive to U.S. companies is transportation costs. Since Mexico is much closer to the U.S. than China, and a stable rail and road network exists between the two countries costs of shipping goods from Mexico to the U.S. is lower. Shorter distance also means that goods can reach U.S. destinations faster from Mexico than transported by ships from China. Unless wage inflation in China stabilizes manufacturing firms may continue to move out to other countries including Mexico, Vietnam, Philippines, etc. From an investment perspective, it is wise to keep on the Mexican economy and equities.

Source: The Comeback by Herman Kamil and Jeremy Zook, Finance & Development, march 2013, IMF

Related ETFs:

iShares MSCI Mexico Capped Investable Market (EWW)

iShares FTSE/Xinhua China 25 Index (FXI)

Disclosure: No Positions