Most of the economic news coming out of Europe are negative. Almost on a daily basis the media reports on a wide range of topics including the shocking unemployment rates in countries such as Greece, Spain, Italy, etc, debt issues, future of the Euro, foreclosure issues in the Spanish real estate market, fragile banking system, Portuguese heading to their former African colony of Angola in search of work, etc. Bombarded with all these negativity news most investors are tempted to stay away from European stocks until some sense of normality returns. However in spite of economic and financial chaos blanketing many of the EU members, investors can find attractive opportunities. Ignoring the constant noise and looking beyond the horizon takes courage and investors willing to hold equities for a few years would be richly rewarded. One way to select stocks in such uncertain conditions is to look for companies with high exposure to overseas markets as opposed to those that mostly depend on domestic markets. Many European companies have strong presence in countries outside of Europe and they should be relatively less impacted due to the turmoil in Europe.

From a recent article titled “Despite Bleak Backdrop, Europe Beckons” in T.Rowe Price Insights:

Europe Features Strong Corporate Fundamentals

European corporations have made major progress by cutting costs and strengthening their balance sheets, leading to improved earnings power and cash flow generation.Faced with muted growth in local markets, managers have increasingly looked overseas for growth opportunities and today have a large presence in, or exposure to, emerging markets.

While European stock markets have gained traction in recent months, valuations are at 25-year lows.

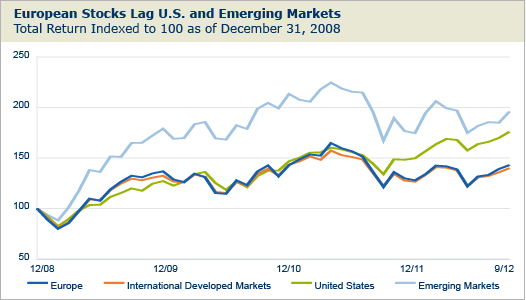

Source: Morgan Stanley Capital International based on MSCI Europe, EAFE, U.S., and Emerging Markets Indices.

Chart is shown for illustrative purposes and does not represent the performance of any specific security. Past performance cannot guarantee future results. It is not possible to invest directly in an index.

Source: Despite Bleak Backdrop, Europe Beckons, T.Rowe Price Insights

An important point to be noted is that it is the governments and public sector that are in trouble and not private sector companies. Corporations adapt to the changing economic landscape and continue to generate profits as much as they can.So investors need not avoid European stocks due to the ongoing crisis faced by some governments.

Ten European non-financial companies with high exposure to markets outside of Europe are listed below for consideration:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.22%

Sector:Beverages (Nonalcoholic)

Country: Switzerland

2.Company: SABMiller PLC (SBMRY)

Current Dividend Yield: 2.96%

Sector: Beverages (Alcoholic)

Country: UK

3.Company: Diageo PLC (DEO)

Current Dividend Yield: 2.32%

Sector: Beverages (Alcoholic)

Country: UK

4.Company: Telefonica SA (TEF)

Current Dividend Yield: 10.28%

Sector: Telecom

Country: Spain

5.Company: Siemens AG (SI)

Current Dividend Yield: 3.76%

Sector:Electronic Instrumentation & Controls

Country: Germany

6.Company: Unilever NV (UN)

Current Dividend Yield: 4.05%

Sector:Food Processing

Country: The Netherlands

7.Company: Danone SA (DANOY)

Current Dividend Yield: 2.81%

Sector:Food Processing

Country: France

8.Company: BASF SE (BASFY)

Current Dividend Yield: 3.68%

Sector: Chemical Manufacturing

Country: Germany

9.Company: British American Tobacco PLC (BTI)

Current Dividend Yield: 4.00%

Sector:Tobacco

Country: UK

10.Company: Total SA (TOT)

Current Dividend Yield: 5.91%

Sector:Oil & Gas – Integrated

Country: France

Note: Dividend yields noted are as of Dec 3, 2012

To answer my title question I would say that investors looking to diversify or add exposure to European companies for 2013 can initiate new positions now through the end of the year taking advantage of the depressed prices and market volatility.

Disclosure: No Positions