Canada is the largest exporter of crude oil and other petroleum products to the U.S. Saudi Arabia ranks as second largest exporter to the U.S. followed by Mexico. Canada maintained the top position in both 2010 and 2011 and is likely to be a key supplier to the U.S. for many years to come.Due to continuing geo-political issues in the Middle East, the Canadian tar sands are bound to become more strategically important to meet the energy needs of the U.S.

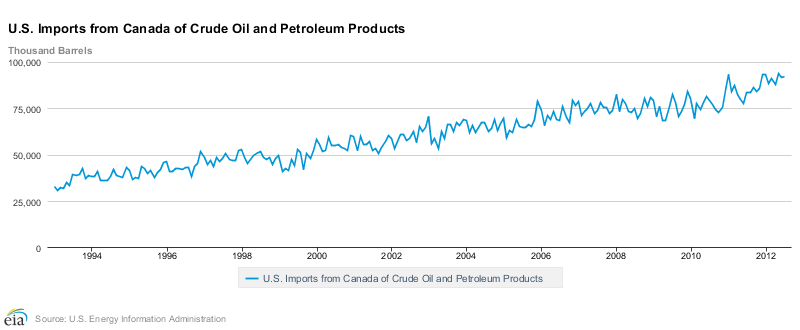

The following graph shows the long-term trend of Canadian Crude Oil and Petroleum Products exports to the U.S.:

Click to enlarge

Source: U.S. Energy Information Administration

In Jan 1991, U.S. imported 32,597(thousand barrels) from Canada. This figure jumped to 57,927(thousand barrels) in the beginning of 2000. By July of this year the U.S. imported 92,154(thousand barrels) for a rise of about three-fold from 1991.

A little-known but an important factor that favors Canadian crude oil over oil from other countries is that the Canadian oil blend is cheaper.

From an article in the CBC news site:

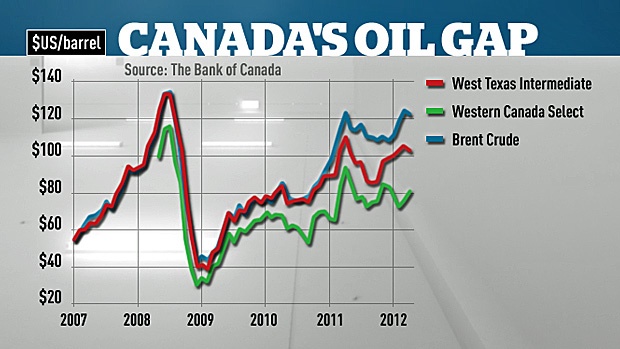

Many factors are pushing the price for North American crude lower, but the hit for Canadian oil companies specifically is even worse. The most prevalent Canadian benchmark is called Western Canadian Select. A blend of conventional oil, bitumen and synthetics, WCS is heavier and therefore more difficult to process than some other types of oil like Brent and WTI.

Because of the added transportation and refining costs, the profit margin a refiner can earn from using WCS is less than they would get from WTI. So refiners are paying Canadian producers less per barrel as a result.

Canada exports almost three million barrels of oil per day, and the spread has at times been in excess of $30 per barrel of late, so that’s $90 million in lost revenue, every day, for the oil patch.

It’s one of the things the Bank of Canada warned about in its latest Monetary Policy Report this week. Despite being awash in fossil fuels, Canadian producers aren’t getting as much money for their crude as suppliers elsewhere in the world do, which eats into GDP.

It’s especially vexing because Canadians pay the same high prices as the rest of the world for finished petroleum products like gasoline. Add it all up and the price Canada pays for the Brent-based oil it imports is going up, and the price Canada gets for the oil we export is going down — giving our economy a hit both coming and going.

How to profit from the growing Canadian crude oil and petroleum products exports to the U.S. market?

One way for investors to capitalize on this growth is to invest in Canadian oil companies that are involved in the exploration, extraction, storage and transportation of crude oil and related products to the U.S. Ten such stocks trading on the US markets are listed below for further research:

1.Company:Imperial Oil Ltd (IMO)

Market Cap: $39.1B

Current Dividend Yield: 1.05%

2.Company: Suncor Energy Inc (SU)

Market Cap: $51.7B

Current Dividend Yield: 1.56%

3.Company: Nexen Inc (NXY)

Market Cap: $13.5B

Current Dividend Yield: 0.80%

4.Company: Enbridge Inc (ENB)

Market Cap: $32.8B

Current Dividend Yield: 2.77%

5.Company: TransCanada Corp (TRP)

Market Cap: $32.6B

Current Dividend Yield: 3.86%

6.Company: Talisman Energy Inc (TLM)

Market Cap: $13.6B

Current Dividend Yield: 2.05%

7.Company: Canadian Natural Resources Ltd (CNQ)

Market Cap: $33.8B

Current Dividend Yield: 1.40%

8.Company: Encana Corp (ECA)

Market Cap: $16.0B

Current Dividend Yield: 3.67%

9.Company: Cenovus Energy Inc (CVE)

Market Cap: $26.5B

Current Dividend Yield: 2.56%

10.Company: Husky Energy Inc (HUSKF)

Market Cap: $27.3B

Current Dividend Yield: N/A

Note: Dividend yields noted are of Oct 6, 2012

Disclosure: No Positions