I came across an interesting article by Jonathan Brodie of South Africa-based Allan Gray Proprietary Limited discussing stock market bubbles and how extreme bearish mainstream media cover stories about investing in stocks are contrary indicators. The famous 1979 BusinessWeek cover that pronounced the ‘Death of Equities‘ was a classic example of such contrary indicators.

Click to enlarge

Some key takeaways from the article:

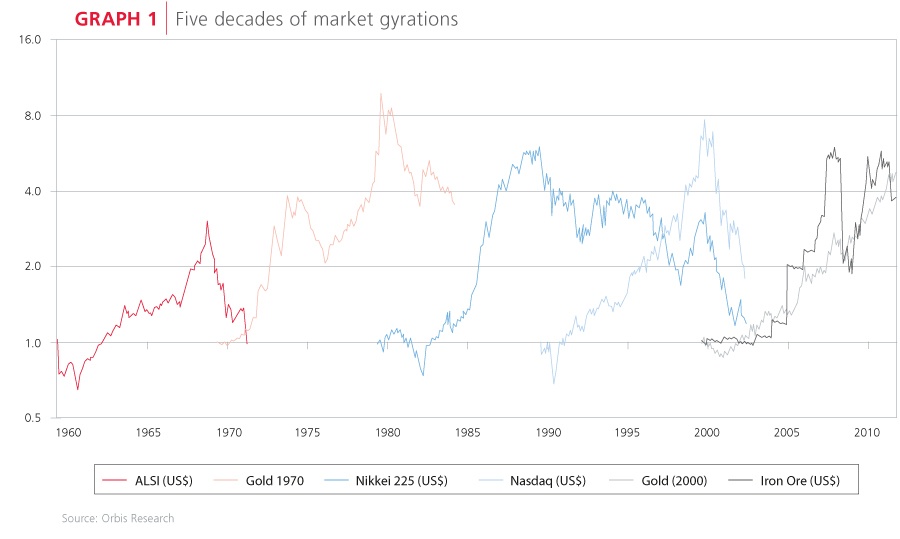

- In the second half of 1980s, the Nikkei 225 nearly quadrupled in value and stood at an all-time high of about 39,000 by the end of 1989. By then books on Japanese management techniques became the craze of the world and then Nikkei lost half its value by 1992 and then halved again by 2003.

- Two decades after the BusinessWeek article, the internet and technology-related stocks propelled Nasdaq to an all-time high only to plunge 70% by 2003 when the dot-com bubble burst. Books such as Dow 36 000 and Jeremy Siegel’s Stocks for the Long Run became the must-reads during the tech mania. The high-tech darling of the time, Cisco Systems (CSCO) became the most valuable company in the world for a brief period. Later the company’s shares collapsed by over 85% when the party ended.

- The rise and fall of South Africa’s FTSE/JSE All Share Index (ALSI) in the 1960s as shown in the chart above is another example of bubble that inevitably bursts. By 1969, the index had risen by about 500% in the decade “prompting the Financial Mail to quote a leading broker who declared that ‘the market is now in orbit, and the force of gravity no longer applies.” The market did not stay in the orbit for too long and after two years the index had lost two-thirds of its value.

The chart above also shows the dramatic rise and fall of gold in the 1970s and iron ore in the last decade.

Source: Investing: a history of bubbles, Jonathan Brodie, Allan Gray Proprietary Limited, South Africa

Related ETFs:

SPDR Gold Trust (GLD)

iShares MSCI South Africa Index (EZA)

PowerShares QQQ Trust (QQQQ)

iShares MSCI Japan Index (EWJ)

Market Vectors Steel (SLX)

Disclosure: No Positions