The U.S. Federal government runs large deficits year after year. This is because total government expenditures far exceed total revenues. For example, under the Obama administration the Federal deficit was $1,293 billion and $1,300 billion for the fiscal years 2010 and 2011 respectively. For the fiscal year 2012 it is projected to reach $1,327 billion.

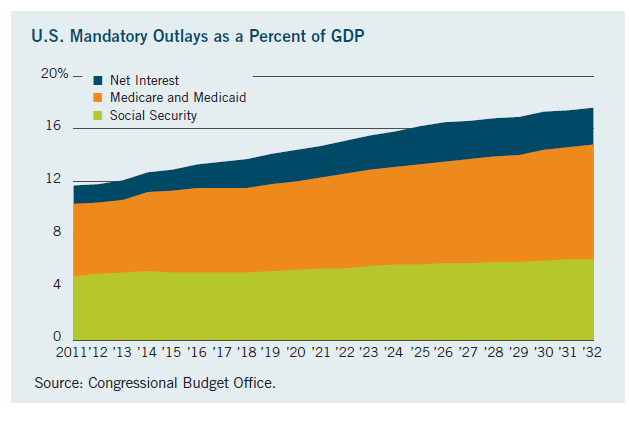

Federal government expenditures rose from 18.5% of GDP in mid-2008 to 23.5% from mid-2009 to late 2010 due to the recession. This ratio has since fallen to 22% and should decrease further in the near term. However according to the Congressional Budget Office, expenditures will continue to remain high due to rising mandatory spending on social entitlement programs. As millions of baby boomers retire and health care costs skyrocket on a yearly basis, the Federal spending on Medicare, Medicaid and Social Security will increase. In addition to these entitlement programs, the interest on the outstanding national debt also will consume a larger portion of the national income. The Treasury Department estimates the U.S. interest expense on debt outstanding to be an astonishing $323,050,646,977.43 or $3.23 Trillion for the fiscal year 2012. The interest expense is so high because the current total public debt outstanding is $15.9 Trillion.

Currently the U.S. outlays for the entitlement programs noted above and interest payments stands at 10.4% of GDP . This is projected to rise to 12.6% in 2022 and 14.8% in 2032.

Click to enlarge

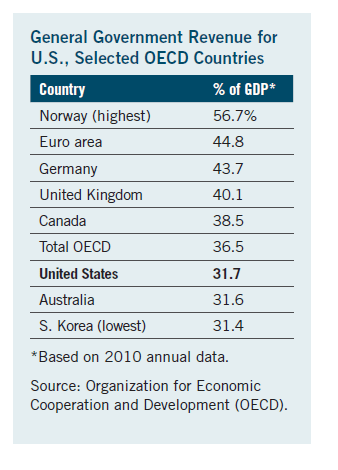

High government expenditures is not necessarily bad if they are matched with adequate revenues.However this is not the case in the US. The current trend of deficit spending is a major concern because unlike other developed countries, the U.S. has one of the lowest rates of tax collection according to the OECD. The general U.S. tax revenues consisting of federal, state, and local levels at about 32% of GDP is one of the lowest rates of collection of the 31 developed countries in the OECD as shown in the chart below:

Last year, the federal government revenues reached a historical low of just 15.4% of GDP compared with the historical average of 18.2%. As Americans are traditionally averse to paying higher taxes but expect more and more payments from Uncle Sam in the form of social safety net programs such as Medicare, Medicaid, Social Security and many others, we can expect deficits to remain high at least for the foreseeable future.

Source: Not So Fast: U.S. Recovery Falters as Fiscal Cliff Looms, By Alan Levenson, T. Rowe Price Chief Economist, T.Rowe Price Report, Summer 2012