The healthcare industry in the U.S. is dominated by a few large companies.Private health insurance firms’ direct written premium totaled $395 billion in 2010. With additional health premiums written by life and other insurers, the total health premiums amounted to $560 billion according to SNL Financial. The number of people with no health insurance increased from 46.3 million in 2008 to 50.7 million in 2009 according to U.S. Census Bureau.

In 2010, about 16.3% of the total U.S. populated lacked any form of coverage for health care.With the passage of Obama’s The Patient Protection and Affordable Care Act (PPACA), these uninsured people will be required to buy health insurance starting in 2014. As a result, health insurers should see their business grow in the coming years and accordingly generate higher profits. In anticipation of the law, many health insurers have already increased premiums to compensate for insuring a larger risk pool.As in the past, healthcare costs is projected to soar more than the inflation rate each year. From an investment standpoint,larger health insurers are a better option than smaller ones since they can maximize the economies of scale and have stronger financial reserves to grow and pay claims.

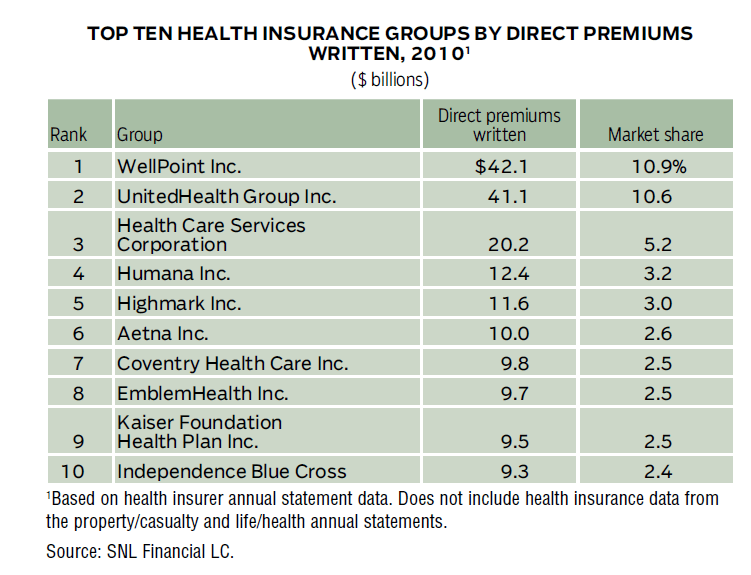

The Top Ten U.S. Health Insurance Companies are shown in the table below:

Source: 2012 Financial Services Fact Book 2012 by Insurance Information Institute and Financial Services Roundtable.

The two largest health insurers by market share are WellPoint(WLP) and UnitedHealth Group(UNH).

Some of the ETFs related to the health insurance industry are Health Care Select Sector SPDR (XLV), Vanguard Health Care ETF (VHT), iShares Dow Jones US Healthcare (IYH) and iShares Dow Jones U.S. Medical Devices Index ETF (IHI).

Disclosure: No Positions