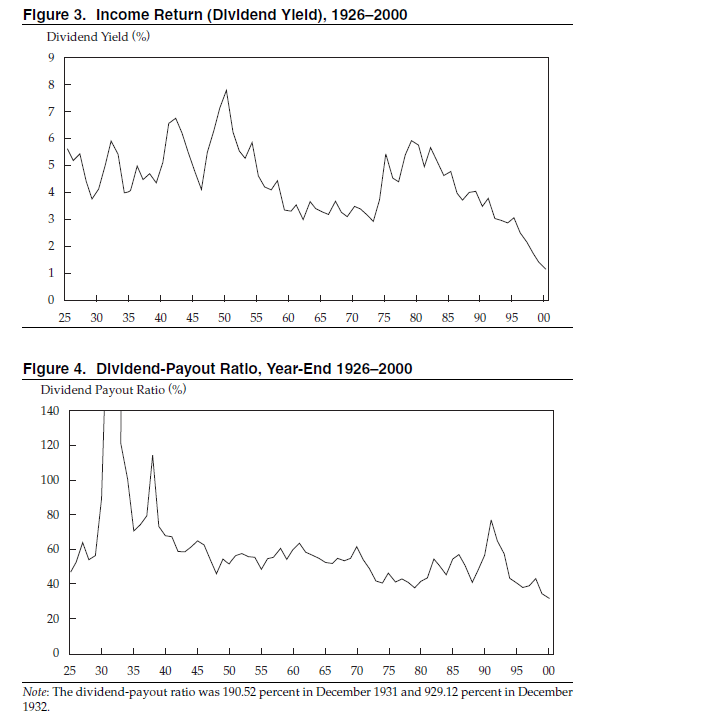

The chart below shows the Dividend Yield and Dividend Payout Ratio of the S&P 500 index 1926 to 2000:

The Dividend Yield dropped from 5.15% at the beginning of 1926 to just 1.10% at the end of 2000.

The Dividend Payout Ratio was at 46.68% the beginning of 1926 but decreased to just 31.78% at the end of 2000. The highest dividend payout ratio was in 1932 and the lowest was in 2000.On average the dollar amount of dividends after inflation grew 1.23% a year, while the dividend-payout ratio decreased by 0.51% per year.

Source: Long-Run Stock Returns: participating in the real economy by Roget G.Ibbotson (Professor of Finance, Yale School of Management) and Peng Chen(Ibbotson Associates)

Related ETF:

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions