U.S. Corporations posted record profits in 2011 according to the latest Fortune 500 list published by Fortune magazine earlier this month. Despite the high unemployment rate in the country, the biggest 500 companies raked in a record-breaking $824.0 billion in combined profits last year. This amount is up 16% from 2010.

Exxon Mobil, the highest ranked firm in the list, alone made a profit of $41.1 billion, up 35% from previous year. The oil giant’s dramatic rise in profit is simply the result of sky-rocketing oil prices in 2011.

Meanwhile since the global financial crisis millions of workers have lost their jobs and many continue to remain unemployed. In April, the unemployment rate stood at 8.1% with some 12.5 million Americans unemployed according to official BLS data.

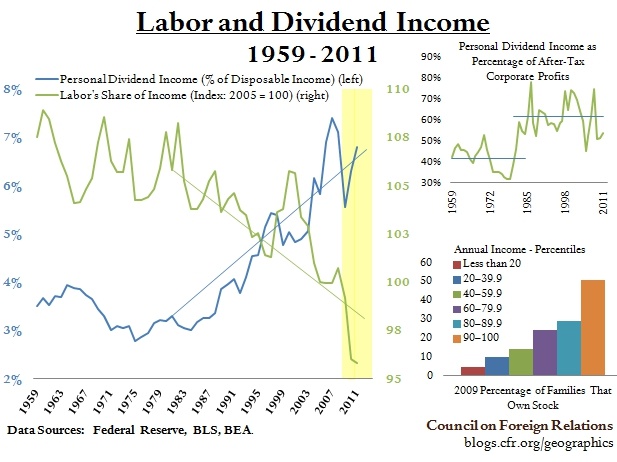

As U.S. companies’ profits soar many pay a higher amount of their earnings in dividends. Since most of the outstanding public stocks are held by the wealthy the majority of the dividend payments go to them. However for many years labor’s share of income has declined. In fact, according to a report by the Council on Foreign Relations labor’s share of income has plummeted since 2009 while personal dividend income as a percentage of disposable income has soared.

Click to enlarge

Source: Where Have All the Profits Gone? Karl Marx Could Have Told You, CFR

The decline of labor’s share of income is not beneficial to the country in the long run.