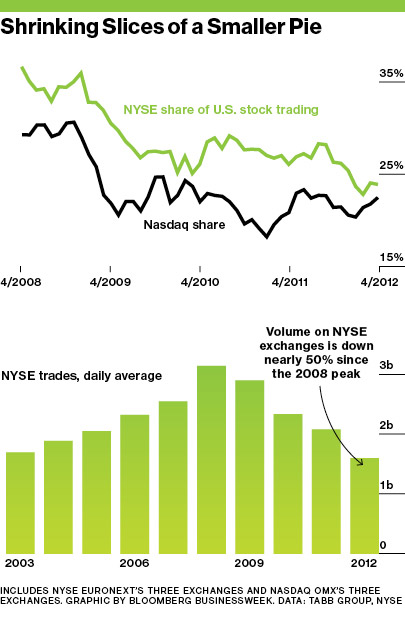

Stock trading on the US exchanges reached a peak in 2008 from steadily increasing yearly since the bursting of the dot com bubble. According to an article in Bloomberg BusinessWeek trading volumes has declined considerably on the NYSE and NASDAQ.

From the report:

Both exchange companies are contending with similar forces: an overall slowdown in trading, the rise of smaller public exchanges such as BATS and Direct Edge, and the increasing number of trades being executed “off exchange”—either at wholesale brokerages or on private trading venues known as dark pools.

Click to enlarge

The general public is already wary of investing in equities due to the recent credit crisis, continuing failure of banks, collapse of the housing market, flash trading, resurgence of high-risk taking by banks using complex derivatives, the never-ending European debt crisis and a myriad of other factors. Added to this list of negative reasons is the rise of dark pools and off exchanges. It is not clear how much markets are impacted due to the new ways of trading. So investors should not read too much into the trading volumes on the organized US exchanges.

Related:

Duration of Stock Holding Periods Continue to Fall Globally