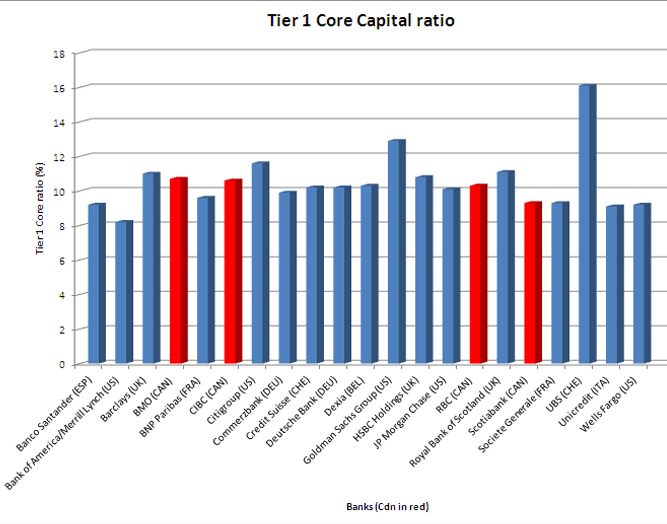

Tier 1 Core Capital is used by regulators to determine the strength of a bank. The higher the ratio the better the position of a bank. The following chart shows the Tier 1 Core Capital Ratio of select large-cap western banks:

Click to enlarge

Note: Data used are based on Q2 2011 reports.

Source: How strong are Western Banks, Canadian Business

From the Canadian Business article:

Tier 1 core capital (or common equity as it is formally called by the Bank for International Settlements) measures a bank’s equity position relative to its assets. It essentially asks, how strong is the foundation on which the bank’s wealth is built? Eligible capital includes common equity and declared reserves, minus certain classes of preferred shares, goodwill and hybrid capital. This is then divided by the total for risk-weighted assets. Because of the deductions it’s considered a finer measure of financial strength than the Tier 1 capital ratio.

Tier 1 Core Capital Ratio definition from Wikipedia:

In the Basel II accord bank capital has been divided into two “tiers” each with some subdivisions.

Tier 1 capital, the more important of the two, consists largely of shareholders’ equity and disclosed reserves. This is the amount paid up to originally purchase the stock (or shares) of the Bank (not the amount those shares are currently trading for on the stock exchange), retained profits subtracting accumulated losses, and other qualifiable Tier 1 capital securities (see below). In simple terms, if the original stockholders contributed $100 to buy their stock and the Bank has made $10 in retained earnings each year since, paid out no dividends, had no other forms of capital and made no losses, after 10 years the Bank’s tier one capital would be $200. Shareholders equity and retained earnings are now commonly referred to as “Core” Tier 1 capital, whereas Tier 1 is core Tier 1 together with other qualifying Tier 1 capital securities.

Canadian banking giant TD Bank(TD) is not included in the above chart since it does not report this ratio. Relative to banks in other developed countries, US banks are much stronger now based on the Tier 1 Core Capital Ratio as they have shored up their capital positions after the financial crisis of 2008. However billions of bad loans especially tied to the real estate sector have still not be written off their books and the suspension of mark-to-market valuation method may have also inflated their asset values. So though US banks appear strong, from an investment point of view an investor has to be extremely selective due to the difficulties in evaluating their true earnings.

Disclosure: Long many banks listed above