I wrote an article last year discussing about the fall in stock holding periods globally. In this post lets take a review how equity and option trading volumes in the U.S. have soared over the years.

The financial services industry is one of the major components of the US economy. While in the past manufacturing and other goods producing industries used to the main drivers of the US economy, in the past few decades they were replaced by the FIRE (Financial Services, Insurance and Real Estate) sector.

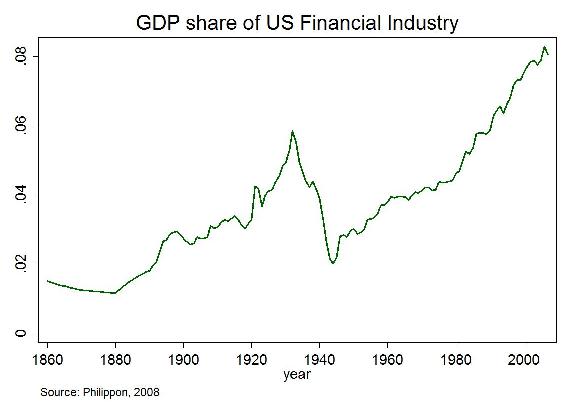

The following chart shows the growth of the US financial services industry as a percentage of the GDP:

Source: The future of the financial industry – Thomas Philippon, Stern on Finance

The financial industry was about 1.5% of GDP in the mid-19th century. From under 2% in 1940s it steadily climbed to reach about 8.3% of the GDP in 2006. And it has continued to remain high since 2006.

In spite of dominating the US economy, the financial industry is one of the most inefficient industries.The main role of the financial industry is to facilitate intermediation of money in the economy. However technological advancements including the IT revolution have not made the industry efficient according to an article by Professor Thomas Philippon of NYU’s Stern School of Business. From the article:

Based on what we see in wholesale and retail trade, IT should have made finance smaller, not larger. What happened? Why did we get the bloated finance industry of today instead of the lean and efficient Wal-Mart? Finance has obviously benefited from the IT revolution and this has certainly lowered the cost of retail finance. Yet, even accounting for all the financial assets created in the US, the cost of intermediation appears to have increased. So why is the non-financial sector transferring so much income to the financial sector?

One simple answer is that technological improvements in finance have mostly been used to increase secondary market activities, i.e., trading.

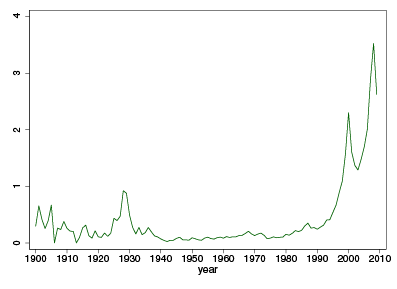

Click to enlarge

Equity Trading Volume over GDP

Figure 5 shows the dollar volume of equity trading over GDP in the US. The finance industry of 1900 was just as able as the finance industry of 2000 to produce bonds and stocks, and it was certainly doing it more cheaply. But the recent levels of trading activities are at least three times larger than at any time in previous history. Trading costs have decreased (Hasbrouck 2009), but the costs of active fund management are large. French (2008) estimates that investors spend 0.67% of asset value trying (in vain, by definition) to beat the market.

Source: Has the finance industry become less efficient? Or Where is Wal-Mart when we need it?, VoxEU

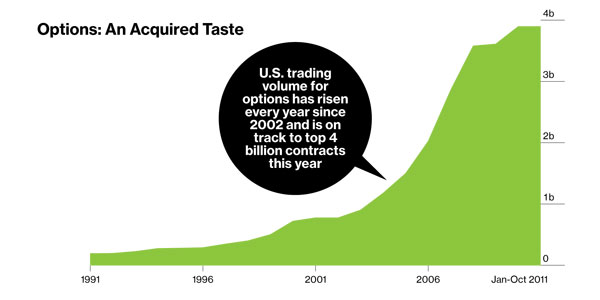

One of the effects of the astronomical increase in trading volume is that stock holding periods have decreased significantly. In addition, volatility has increased with High-Frequency Trading (HFT) and other activities worsening the situation. Trading volumes for options has also increased in the past few years according to a report in Bloomberg BusinessWeek:  Source: Online Brokers Court Option Traders, Bloomberg BusinessWeek

Source: Online Brokers Court Option Traders, Bloomberg BusinessWeek

In summary, though the cost of trading stocks and other instruments have become extremely cheap it does not necessarily mean investors are reaping the benefits of growth in technology. In my opinion, the opposite is true. Easier and cheaper trading has turned many investors into short-term traders instead of long-term investors.