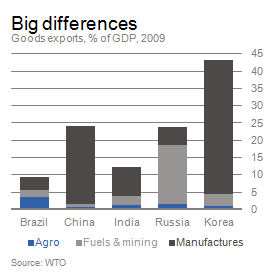

Brazil, Russia, India and China vary widely in terms of goods exports as shown in the following graph.

Manufactured goods form a major portion of goods exports for China and South Korea compared to agricultural products, fuels and minerals. Russia’s goods exports is dominated by crude oil and natural gas. India is also a large exporter of manufactured goods exports relative to the other two types.

Source: Brazil as a commodity exporter – opportunities & risks, Markus Jaeger, Deutsche Bank Research

Among the BRICs, Brazil has a more diversified export base even within commodities. Hence Brazil can be called as a “diversified commodity exporter”. After the EU, China remains the largest export market for Brazil accounting for about 15% of total exports.

The general belief among investors that Brazil is a pure “commodity play” is simply not true. Manufactured exports represent about 40% of total exports.

From the Deutsche Bank Research article:

Food and agricultural raw materials make up 2/5 of its goods exports. Brazil is the world’s leading exporter of soybeans, poultry, beef, orange juice, coffee and sugar. The top five export products in terms of value are iron ore, oils & fuels, transport equipment (aircraft), soy and sugar & ethanol. Moreover, Brazil’s agricultural potential is huge. Its potential arable land is estimated at over 400m hectares (FAO), but only 50m are currently being used, and Brazil has more spare farmland than the next two largest countries combined.

Similarly, the recent discovery of so-called “pre-salt (oil) deposits” has the potential to propel Brazil from 15th to 5th place in terms of proven reserves. It will, if successfully exploited, transform the country into an important oil exporter – and provide the government and the economy with a significant revenue windfall. This offers a huge opportunity to accelerate economic development, provided the windfall is spent wisely by investing in education and infrastructure and provided the country can avoid “Dutch disease” related problems. In short, Brazil is very well positioned to benefit from what may be a longer-lasting shift in the global economy: the economic rise of populous and relatively resource-scarce countries such as China and India.

From an investment point of view, Brazil is a better destination than other BRIC countries for some of the reasons mentioned above.

Related ETFs:

PowerShares India (PIN)

iShares S&P India Nifty 50 (INDY)

iShares MSCI Brazil Index (EWZ)

Market Vectors Russia ETF (RSX)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

iShares MSCI Brazil Index (EWZ)

Disclosure: No Positions