Commodities have become an attractive asset class to ordinary investors in the past few years. Heavy marketing by Wall Street firms and the dismal economic situation have made investors turn to commodities for higher returns. However unlike other assets, commodities are extremely volatile, unpredictable and are affected by a multitude of factors that are difficult to evaluate. For example, while it easy for an ordinary investor to bet on Wheat, Corn or Crude Oil understanding the dynamics of those markets such as the concept of Contango are not easy.Similar problem exists with other commodities such as metals like steel and precious metals like Gold, Silver, Platinum, etc.

Before jumping into commodities investors have to understand the risks involved and realize that commodity prices can move violently up or down within a short period of time.

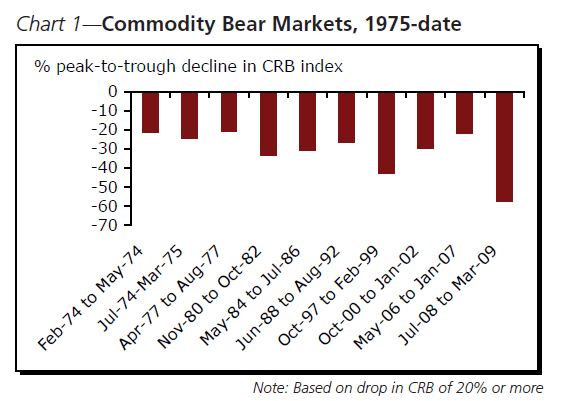

The following chart shows the bear markets in commodities since 1975:

Source: Commodities: Canaries in the Global Economic Mineshaft, CIBC Commodities Update

From the CIBC report:

There have been 10 bear resource markets in the last 35 years, lasting about 16 months on average. Including 2008-09’s particularly savage retreat, those episodes have seen prices drop by about 30% on average, on a peak-to-trough basis, half again the scale of the recent pullback.

Some related ETFs:

ProShares Ultra Oil & Gas (DIG)

United States Natural Gas Fund LP (UNG)

iShares Silver Trust (SLV)

The Teucrium Corn ETF (CORN)

Disclosure: No Positions