Sovereign debt defaults has become a topic of investors’ worry in the past few years. Some of the European countries such as Greece, Spain, Italy, Portugal, etc. are suffering from fiscal issues and may default on their debts. At the height of the credit crisis some suggested that the US may have to default should China and other creditor nations reject to buy US debt. However until now none of the countries noted above have defaulted despite some having their credit ratings cut.

The following are some of the key points on sovereign debt defaults based on Credit Suisse Research Institute’s Country Indebtedness – An Update earlier this year:

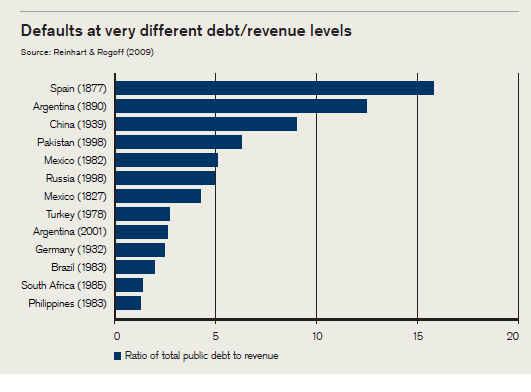

- Defaults can occur at a wide range of government debt-to-revenues ratios as shown in the graph below:

- History’s first recorded sovereign default occurred in the fourth century B.C. in Greece when a group of city-states defaulted on loans from Delos Temple.

- Forced loans, heavy taxation and currency debasement were the hallmarks of the decline of the mighty Roman Empire. It is interesting to note that the U.S. is currently following two of these policies just like the Romans did.

- The Knights Templar essentially became a commercial bank in the 13th century lending to monarchs.

- In the 15th and 16th century, Spain enjoyed its golden period due to its colonial power in South America. But despite the accumulation of extraordinary wealth Spain became a serial defaulter missing payments at least nine times between 1557 and 1662.

- Many European countries defaulted on external debt from 1300 to 1800 including Austria(once),England (twice), France (eight times), Prussia (once), Portugal (once) and Spain(six times).

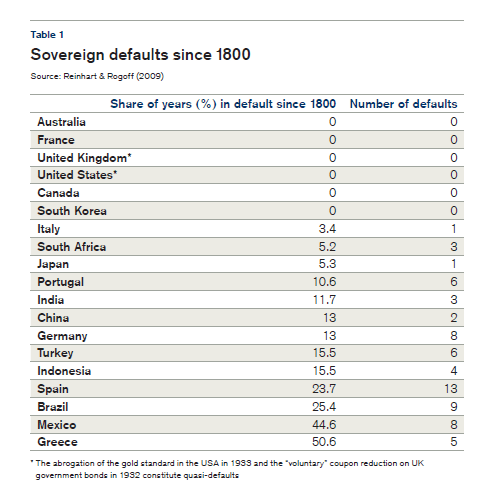

- Sovereign defaults since the 1800s are shown below:

- Government debt holders were wiped out by hyperinflation in Germany(twice) and France(once) as a result of war.

- The U.S. Federal government default twice – once following the War of Independence and after abandoning the gold standard in 1933.

- In the fiat money period since 1973, no rich country has defaulted.

Source: Country Indebtedness – An Update , Credit Suisse Research Institute, January 2011