Transfer payments are government payments to individuals in the form of social security, unemployment benefits, disability benefits, food stamps, etc. Some of these payments are big expenditure for the government and have increased in recent years. For example, food stamp expenditures totaled $64.7 billion for the fiscal year ending in September 2010 and is projected to exceed to $70 billion this year.

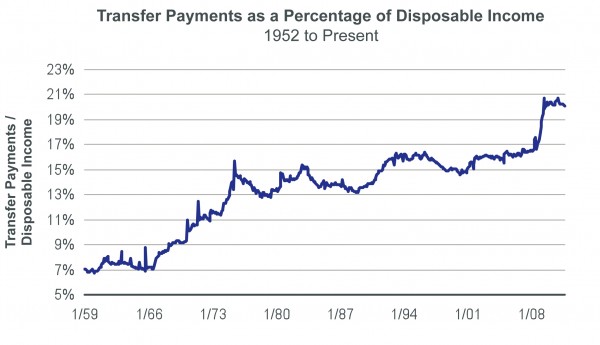

Trasnfer payments as a percentage of disposable income have increased consistently since the 1950s as shown in the chart below:

Transfer payments now account for about 20% of disposable income. As disposable income is critical for the consumption-based US economy, transfer payments are also important. Hence a decrease in transfer payments will negatively impact the economy. Unfortunately these payments have started to decrease in the past couple of months as shown in the chart above due to belt tightening by the government and the ending of some Federal stimulus programs. According to an article by Russ Koesterich of the iShares blog, additional reduction in transfer payments may increase the chances of a double-dip recession significantly.

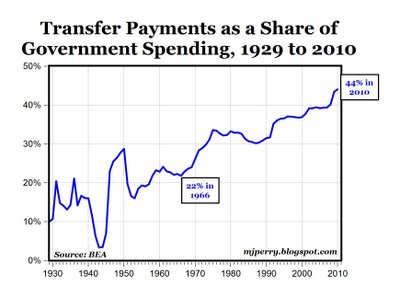

Looking from another angle, Transfer Payments as a share of Government Spending is also steadily rising as shown in the chart below. It has doubled from 22% in 1966 to 44% in 2010 according to an article by Professor Dr. Mark J. Perry of the University of Michigan.

Click to enlarge

Rising transfer payments is not conducive for the overall advancement of the country as they can turn the U.S. into a “nanny state” similar to many countries in Europe. Instead of trying to help the disadvantaged with payments, the Federal government should develop policies for sustainable economic growth that can reduce people’s dependency on welfare.

Sources:

Transfer Payments and the Risk of a Double Dip, Advisor Perspectives

Chart of the Day: Transfer Payments, Carpe Diem