The U.S. markets made a dramatic turnaround today with the S&P 500 soaring 4.1% in the final 50 minutes of trading. Up until few weeks ago US stocks had held up well compared to European stocks as investors assumed the European debt crisis would have a smaller impact here. However despite the perceived strength of the US economy many fundamental problems still remain.

I came across a research paper titled “Lessons We Should Have Learned from the Global Financial Crisis but Didn’t” by Randall Wray of Levy Economics Institute of Bard College, NY. From the paper:

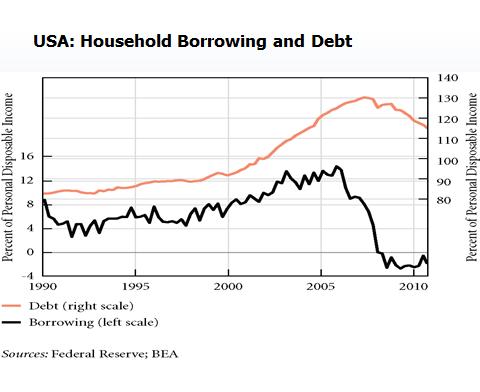

Almost all the debt that we had in 2007 still exists. Households have repaid some, and they have defaulted on some, but most of it still exists, as shown in the next figure. Meanwhile, households have lost their jobs, and a lot of them have lost their houses—which doesn’t mean they have lost the debt because in a lot of cases they still owe the money but they don’t have the house. House prices have declined by about a third across the country, and they are still declining. So there is no way that households and firms are better off now than they were in 2007. In most ways they are much worse. A have of defaults on commercial real estate could be the next thing to hit. Or, student loans or credit card debt could trigger the next crisis as the value of those assets gets downgraded. That is one path back into crisis.

The author also notes that another trigger for a crisis could be that banking regulators might discover one or more big banks to be massively insolvent. He suggests Citigroup(C) and Bank of America(BAC) could be the banks where such problems begin as both of them are still saddled with huge debts that have not been written off.

Mr.Randall makes an excellent point. Though banks and other firms are allowed to write off bad debts, individuals do not get the same privilege. As a result, people are on the hook for any debt owed to banks and banks hold the authority to to recover the amount or forgive based on individual circumstances. The following story in The Wall Street Journal shows the lengths to which some banks will go to recover every cent owed even if it is a home loan which are usually non-recourse in the U.S.

From House Is Gone but Debt Lives On in the WSJ:

LEHIGH ACRES, Fla.—Joseph Reilly lost his vacation home here last year when he was out of work and stopped paying his mortgage. The bank took the house and sold it. Mr. Reilly thought that was the end of it.

In June, he learned otherwise. A phone call informed him of a court judgment against him for $192,576.71.

It turned out that at a foreclosure sale, his former house fetched less than a quarter of what Mr. Reilly owed on it. His bank sued him for the rest.

The result was a foreclosure hangover that homeowners rarely anticipate but increasingly face: a “deficiency judgment.”

Forty-one states and the District of Columbia permit lenders to sue borrowers for mortgage debt still left after a foreclosure sale. The economics of today’s battered housing market mean that lenders are doing so more and more.

With the unemployment rate remaining high and millions of homeowners underwater on their mortgages and the real estate market showing a lack of any recovery the chances for another crisis is indeed high.

Disclosure: No positions