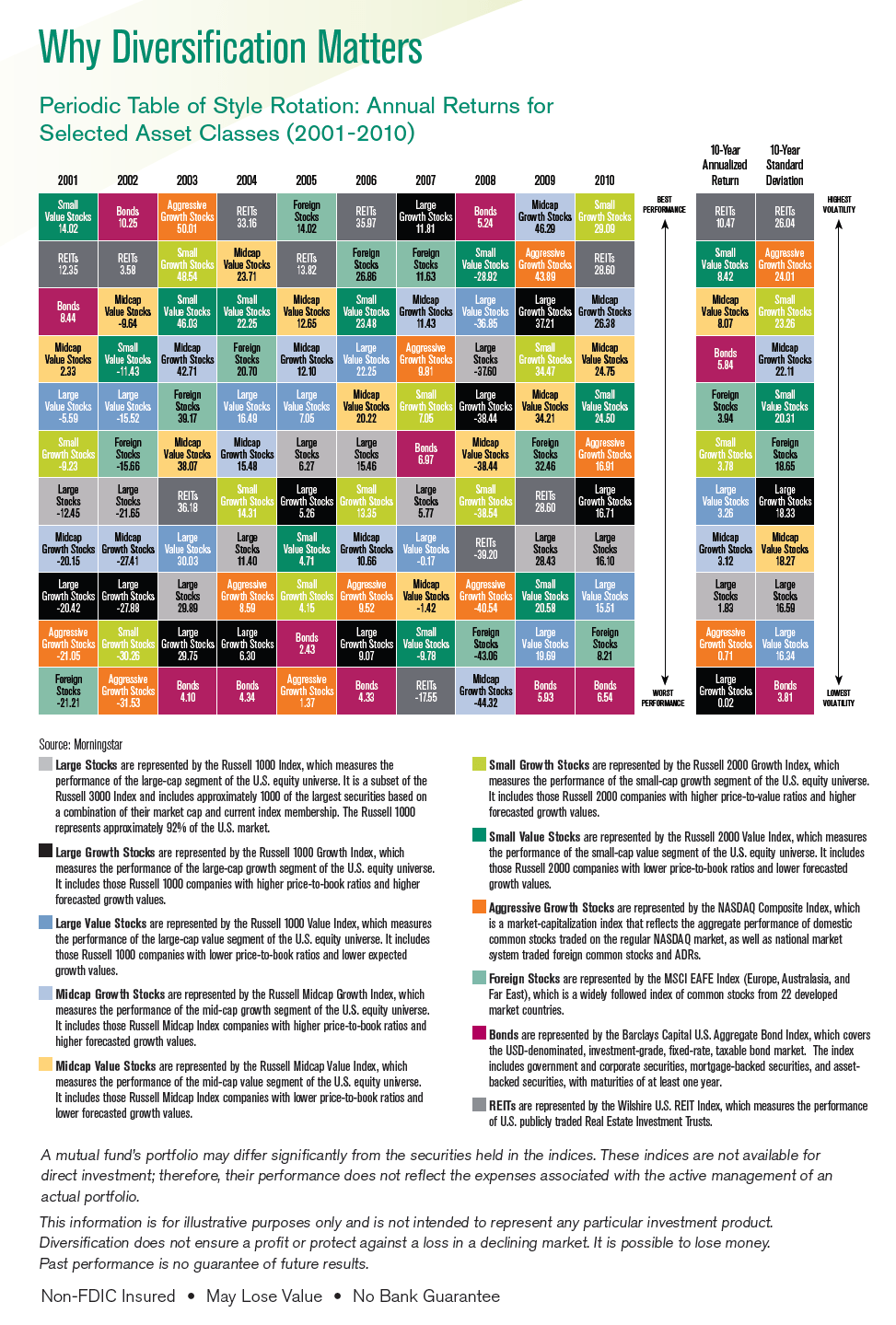

The following chart shows the returns of various asset classes from 2001 to 2010:

Click to enlarge

The 10-year annualized return for foreign stocks was 3.94%. However they returned over 32% in 2009 and 8% in 2010. While foreign stocks fell over 43% during the credit crisis in 2008, they yielded double digit returns every year except 2001 and 2002.

Small cap value stocks performed better than large caps in the period shown. Compared to large cap stocks, the annualized returns of small and mid cap stocks over the 10-year period was higher as well.

Source: Time-Tested Investment Strategies for the Long Term, American Century Investments

Related:

Why Diversification Matters:The Randomness of Returns (Chart from 1997 to 2011 in pdf)