When hot money flows into an emerging country it can create spectacular rises in equity markets. However when the flow of hot money reverses course, the inevitable crashes will be terrifying as well.

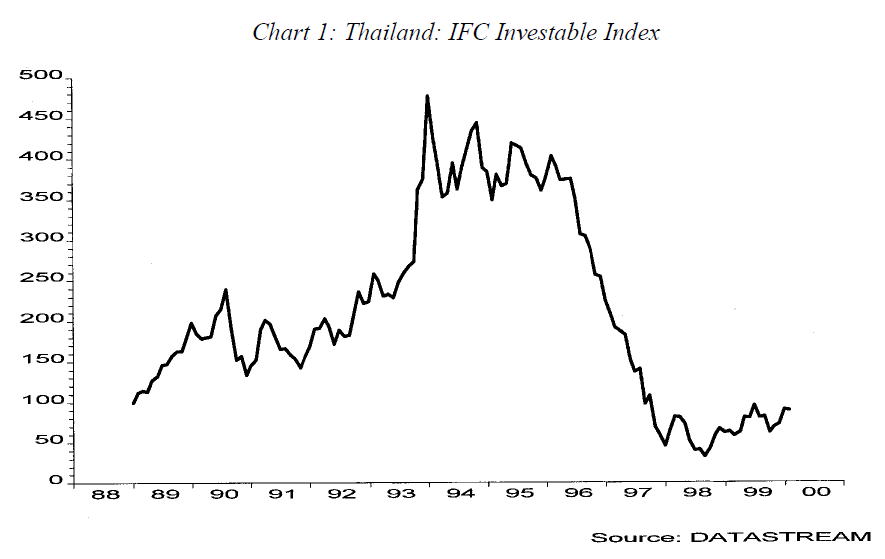

The following chart shows the performance of the Thailand IFC Investable Index from 1988 to 2000:

Click to enlarge

In the early 90s, due to high interest rates and strong growth, Thailand and other East Asian countries received large flows of hot money and experienced a dramatic boom in asset prices.

From Hot Money and Capital Controls in Thailand by Third World Network:

Fixed exchange rates also encouraged external borrowing and led to excessive exposure to foreign exchange risk in both the financial and corporate sectors. A fixed exchange rate regime, free capital mobility, inept regulatory authorities, a weak financial sector as well as reckless behaviour of both borrowers and lenders all combined to render the Thai economy extremely vulnerable to external financial shocks. In 1996, the global economic environment started to change. As the US economy recovered from a recession in the early 1990s, the Federal Reserve began to raise interest rates to head off inflation, making the United States relatively more attractive as an investment destination. At the same time, Thai export growth slowed down sharply, deteriorating its current account position. Loss of confidence in Thailand’s economic and financial system as well as the sustainability of the THB prompted speculators to attack the currency in 1996 and mid-1997.

Note: THB – Thai Bhat

When hot money reverses direction as is the case of Thailand, monetary authorities are caught off-guard and left with little time to respond. As a result, the Thai Bhat lost more than half of its value by January 1998. The stock market plunged by an incredible 75% in 1997 alone. The massive devaluation of the Bhat and hikes in interest rates that followed crushed the real economy as bankruptcies sky-rocketed and non-performing loans in the financial sector soared.

In summary, the Thai experience shows the extreme risk involved with investing in emerging and frontier markets. Asset prices can reach the stratosphere only to fall back to earth in no time. Investors venturing into these markets have to adjust their risk tolerance levels accordingly.